Walmart Layoffs 2025: Should You Sell WMT Stock as Tariffs Drive the Retailer to Job Cuts?

/People%20shopping%20at%20a%20Walmart%20store%20by%20Photography%20via%20Shutterstock.jpg)

Over the past year, retail giants have been navigating a perfect storm of rising costs, shifting consumer habits, and geopolitical headwinds, putting even the most resilient chains under pressure. While Walmart (WMT) has long been viewed as a bulwark against inflation thanks to its scale and low‐price positioning, escalating tariffs threaten to squeeze margins and force difficult decisions.

In late May, Walmart announced plans to cut roughly 1,500 corporate jobs as part of a broader restructuring effort aimed at “removing layers and complexity, speeding up decision‐making and helping associates innovate rapidly,” according to a memo from CTO Suresh Kumar and U.S. CEO John Furner. The layoffs, focused on its global tech teams, advertising arm, and e-commerce fulfillment operations, come alongside warnings that the retailer will have to raise prices if the highest‐impact tariffs remain in place. MarketWatch reports that the job cuts are “another way to deal with tariffs.”

For investors weighing whether to hold or sell WMT stock, these moves could signal both short‐term headwinds and long‐term efficiency gains. Here’s what to consider before deciding.

About WMT Stock

Walmart is an American retail powerhouse operating supercenters, discount department stores, and extensive grocery outlets worldwide. Over the past few decades, the company has grown into the largest retailer by revenue, known for its everyday low-price strategy. Currently, it owns 10,771 stores and clubs across 24 countries.

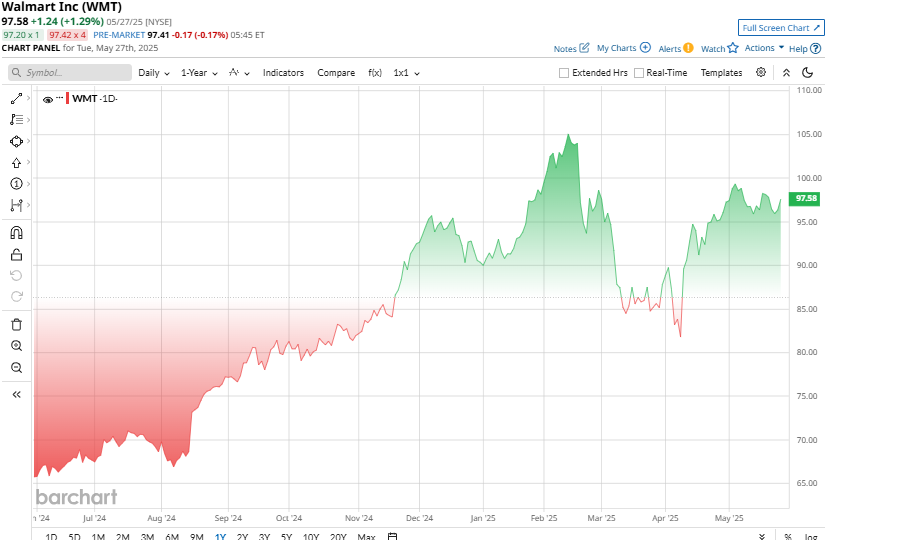

With a market capitalization of about $780 billion, Walmart’s shares slid more than 22% from mid-February through early April as investors braced for tariff headwinds. Since hitting a low of $81 in early April, however, the stock has rallied by over 20% to around $97. Overall, the stock is up approximately 8% year-to-date, outperforming the broader market.

In terms of valuation, Walmart is currently trading at premium levels. Its trailing price-earnings ratio of 38x is significantly higher than the sector median of 16.5x as well as its historical norms of 26x. This means investors expect above-average growth but have less room for error.

Walmart Delivered Mixed Q1 Results

On May 15, the retail giant reported its Q1 results for fiscal year 2026. Despite beating earnings estimates, it was the weakest quarter since 2022. Walmart posted adjusted EPS of $0.61 that topped the $0.58 consensus by 5%, while revenue of $165.6 billion fell just shy of the $165.84 billion forecast. Notably, inventory climbed nearly 4% year over year, marking the first time since early 2022 that stockpiles have outpaced revenue growth, a reversal of the retailer’s typical business cadence.

The e-commerce business reported revenue growth of 20% and turned profitable this quarter, thanks to higher delivery density, with U.S. and Sam’s Club online operations in the black and international channels slightly unprofitable. Meanwhile, Walmart Connect, the company’s advertising business, jumped 31% in the U.S. and 50% globally, highlighting its margin-rich contribution amid pressure on core retail margins.

Looking ahead, management reaffirmed full-year fiscal 2026 guidance for 3%–4% sales growth and expects Q2 sales to rise 3.5%–4.5%.

What Do Analysts Think About WMT Stock?

Wall Street analysts remain highly optimistic about Walmart’s growth prospects, as reflected in a consensus “Strong Buy” rating. Of 38 covering the stock, 32 rate it a “Strong Buy,” five a “Moderate Buy,” and one a “Hold,” with no “Sell” recommendations.

The average 12-month price target is $108.79, implying roughly 11% upside potential from here.

The Bottom Line

Walmart’s 2025 corporate cuts and tariff-driven price hikes aim to shore up margins and boost efficiency, but risk straining staff and testing consumer loyalty. Strong e-commerce results, solid guidance, and widespread analyst support suggest WMT remains a buy-and-hold pick for those weathering near-term volatility.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.