lululemon athletica's Quarterly Earnings Preview: What You Need to Know

/Lululemon%20Athletica%20inc_%20storefront%20by-%20Robert%20Way%20via%20iStock.jpg)

With a market cap of $26.3 billion, lululemon athletica inc. (LULU) designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand. The company operates globally through a mix of company-operated stores, e-commerce, and innovative retail formats like pop-ups and re-commerce programs.

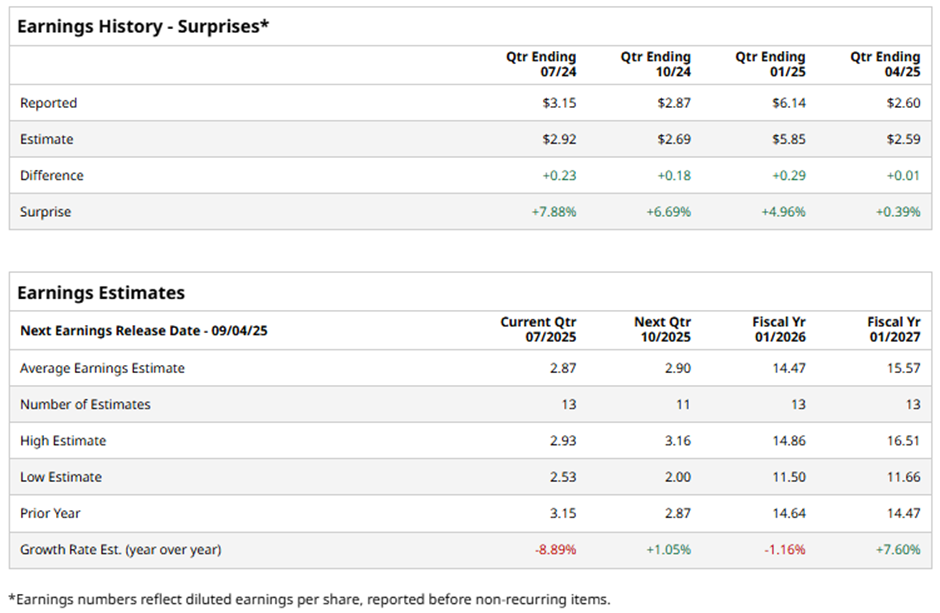

The Vancouver, Canada-based company is expected to announce its fiscal Q2 2025 earnings results on Thursday, Sept. 4. Ahead of this event, analysts expect lululemon athletica to report an EPS of $2.87, down 8.9% from $3.15 in the year-ago quarter. However, it has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the athletic apparel maker to report an EPS of $14.47, down 1.2% from $14.64 in fiscal 2024. However, EPS is anticipated to rebound and grow 7.6% year-over-year to $15.57 in fiscal 2026.

Shares of lululemon athletica have declined 11.3% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 18.3% gain and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 24.5% return over the period.

Despite reporting better-than-expected Q1 2025 earnings of $2.60 per share and revenue of $2.4 billion on Jun. 5, Lululemon Athletica's stock plunged 19.8% the next day due to its reduced full-year EPS guidance to $14.58 - $14.78. The company also issued a weaker-than-expected Q2 EPS forecast of $2.85 - $2.90, significantly below Wall Street’s estimate. Investor sentiment was further dampened by a 2% decline in America's sales and management’s warning that rising tariffs would pressure margins more than expected, with full-year gross margin forecast to shrink by 110 basis points.

Analysts' consensus view on LULU stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 30 analysts covering the stock, 13 recommend "Strong Buy," one has a "Moderate Buy," 12 indicate “Hold,” two advise "Moderate Sell," and two give "Strong Sell." As of writing, the stock is trading below the average analyst price target of $304.41.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.