Southern Company Stock Outlook: Is Wall Street Bullish or Bearish?

With a market cap of $105.6 billion, The Southern Company (SO) is a leading U.S. energy utility headquartered in Atlanta, Georgia. The company provides electricity and natural gas to over 9 million customers across the southeastern United States through its subsidiaries.

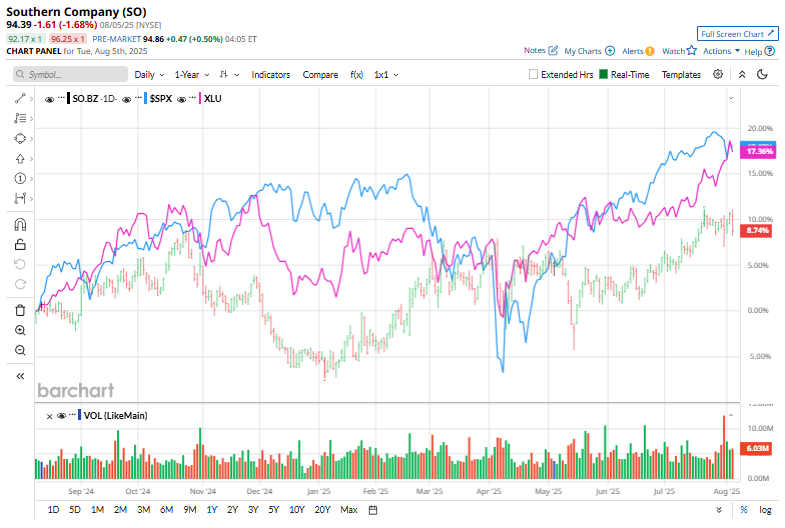

Shares of the utility giant have underperformed the broader market over the past 52 weeks. Southern Company stock has climbed 9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 21.5%. However, shares of SO are up 14.7% on a YTD basis, outpacing the SPX's 7.1% rise.

Looking closer, the power company has also trailed the Utilities Select Sector SPDR Fund's (XLU) 19.6% return over the past 52 weeks.

On Jul. 31, SO released its Q2 earnings, and its shares dropped marginally. Its revenue rose 8% year-over-year to $7 billion, surpassing analyst expectations, driven by continued strength in electricity demand, particularly from data centers and industrial customers, reflecting the ongoing digital and economic expansion across the Southeastern U.S. Its adjusted EPS came in at $0.92, slightly below the consensus estimate of $0.93.

For the fiscal year ending in December 2025, analysts expect SO's EPS to grow 5.7% year-over-year to $4.28. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

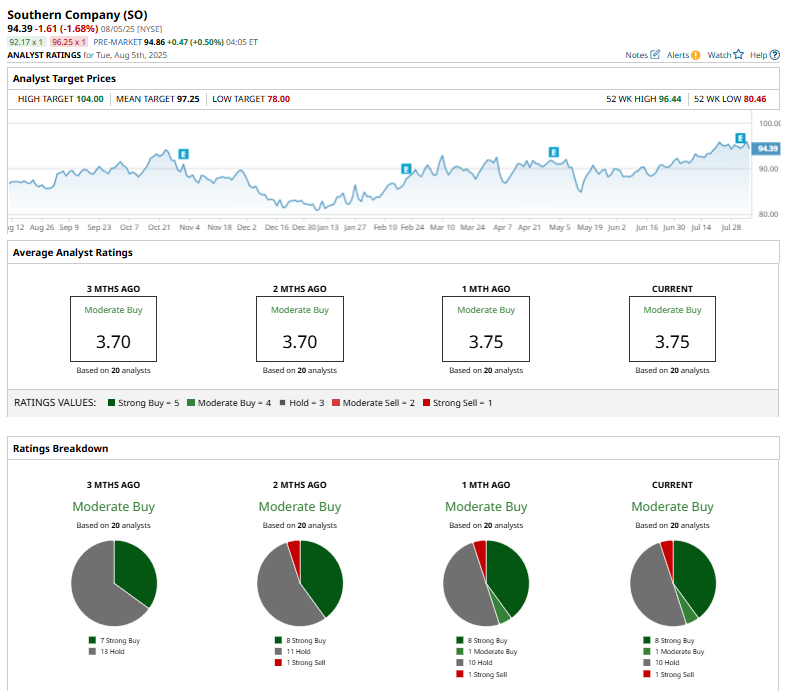

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, one “Moderate Buy,” 10 “Holds,” and one “Strong Sell.”

The current consensus is more bullish than three months ago, when seven analysts gave the stock a “Strong Buy.”

On Aug. 1, Scotiabank analyst Andrew Weisel reaffirmed a “Sector Outperform” rating and a $98 price target on Southern following its Q1 2025 earnings. Weisel highlighted the company’s consistent EPS growth and low-risk profile, thanks to its operations in supportive regulatory environments, and noted that management’s confident outlook helped offset concerns over soft demand in the quarter.

SO’s mean price target of $97.25 indicates a premium of 3% from the current market prices. The Street-high price target of $104 implies a potential upside of 10.2%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.