Supermicro’s Earnings Selloff Explained: Should You Buy SMCI Stock Now?

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

Super Micro Computer (SMCI), known commonly as Supermicro, faced a sharp selloff after its fiscal fourth-quarter earnings report disappointed investors. SMCI stock dropped more than 17% in morning trading following the release, as the company’s earnings and guidance fell short of expectations, raising fresh concerns about slowing growth and tighter competition.

Here’s What Led to the Selloff in Supermicro Stock

Supermicro, known for its high-performance server and storage systems, has been a key beneficiary of the artificial intelligence boom. Its products are tailored for artificial intelligence (AI)-specific workloads, helping fuel tremendous growth in fiscal 2024. However, that momentum appears to be cooling, at least in the short term. In its latest quarter, SMCI reported revenue of $5.8 billion, representing a 7.4% increase year-over-year. While that’s still growth, it marks a noticeable deceleration compared to previous quarters. For instance, its revenue was up 19.5% in Q3, 54.9% in Q2, and a staggering 180.1% in Q1.

The disappointment didn’t stop with the Q4 results. Management’s guidance for the first quarter of fiscal 2026 also underwhelmed. Supermicro forecast revenue between $6 billion and $7 billion and adjusted earnings per share between $0.40 and $0.52, both lower than analysts’ expectations. Wall Street was expecting $6.6 billion in revenue and $0.59 EPS.

Much of this slowdown appears tied to a broader pause in AI-related hardware purchases. As the AI ecosystem undergoes another transition, most notably Nvidia’s (NVDA) shift from its Hopper to Blackwell GPU architecture, customers appear to be pausing some purchases, waiting to see how the landscape evolves. This temporary slowdown has created a speed bump in Supermicro’s growth trajectory.

At the same time, the company faces intensifying competitive pressure from industry giants Dell (DELL) and Hewlett Packard Enterprise (HPE). While Supermicro is shifting toward higher-margin revenue streams to help sustain profitability, these competitive headwinds could continue to put pressure on margins in the near term.

Management remains optimistic about a stronger second half of fiscal 2026, expecting growth to reaccelerate as new AI platforms are deployed and demand rebounds. But in the near term, the combination of slowing growth, weak guidance, and macro uncertainty could continue to weigh on Supermicro stock.

Is SMCI Stock a Buy Now?

Supermicro is poised to gain from the growing demand for AI infrastructure. Its leadership in AI platforms and a broad range of solutions optimized for the latest GPU technologies, including NVIDIA B200 systems and Advanced Micro Device’s (AMD) Instinct MI350 Series GPUs, provides a significant runway for growth.

Notably, the demand for its AI-optimized platforms has been strong, and over 70% of Supermicro’s total revenue now comes from its AI GPU offerings.

Supermicro has been aggressive in expanding both its product range and manufacturing capacity. Its DCBBS, which helps in building data centers more quickly, is likely to see significant demand. The company is also ramping up offerings in air-cooled and direct liquid cooling (DLC) AI systems, positioning itself as a go-to provider for cutting-edge, green computing solutions.

Looking ahead, management expects revenue of $33 billion for fiscal 2026, up 50% year-over-year. The acceleration in growth will likely be driven by its expanding enterprise customer base, upcoming product innovation, and momentum in DCBBS's total solution.

However, it’s not all smooth sailing. While SMCI’s revenue growth is expected to accelerate, it faces intensifying competition from legacy players and specialized AI server providers, which could pressure its margins. Moreover, SMCI’s valuation has become a point of concern. Supermicro trades at a forward P/E ratio of 28.4x, considerably higher than peers like Dell Technologies (15.2x) and Hewlett Packard Enterprise (12.8x). That premium pricing raises the bar for future performance and leaves little room for missteps.

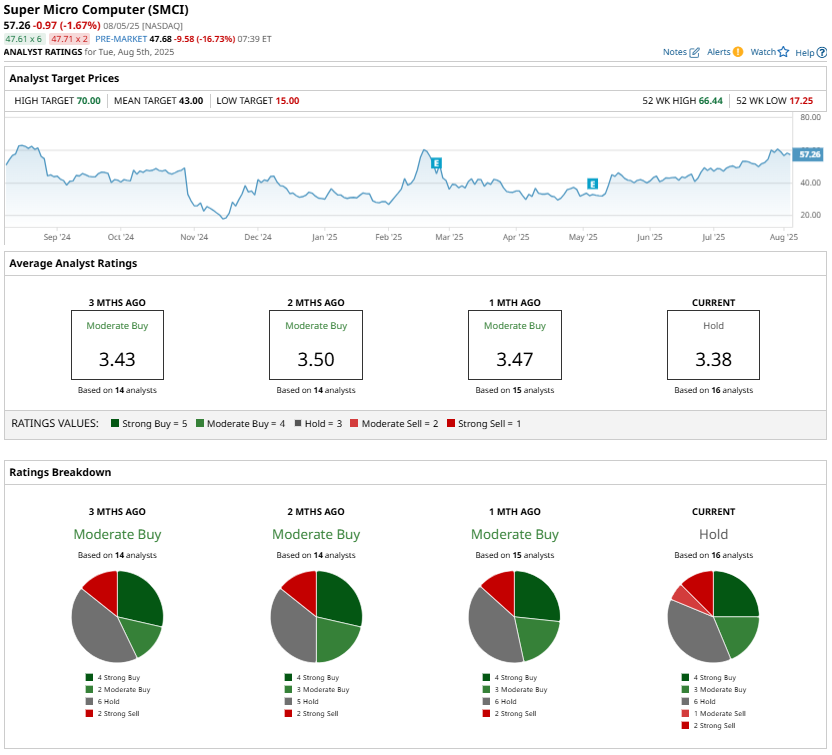

In contrast, Dell, with its double-digit earnings growth forecast and relatively attractive valuation, offers a more compelling case for value-conscious investors. Analyst sentiment reflects this view. While SMCI has a “Hold” consensus rating, Dell stock enjoys a “Strong Buy” endorsement.

Given Supermicro’s premium valuation and recent stock volatility, investors may find better risk-reward in alternatives like Dell for now. That said, for those willing to bet on AI infrastructure’s long-term trajectory and are comfortable with higher valuation multiples and volatility, SMCI remains a company to watch closely.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.