What Are Wall Street Analysts' Target Price for ConocoPhillips Stock?

With a strong presence across 16 countries, ConocoPhillips (COP), based in Houston, Texas, produces, transports, and markets everything from Crude Oil and bitumen to LNG and natural gas liquids. With a market cap of $117.8 billion, it is one of the largest independent oil and natural gas exploration and production companies in the world. It operates across key energy-producing regions, including the Lower 48 states, Alaska, Canada, the North Sea, the Middle East, and Asia-Pacific.

Over the past year, COP stock has been swimming against the tide, shedding 12% of its value, a sharp contrast to the S&P 500 Index ($SPX), which climbed 21.1% during the same time window. The underperformance has continued into 2025, as the stock is down 6.1%, while the S&P 500 has advanced 7.9%.

Zooming in, it has lagged behind the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), which has fallen 5.9% over the last 52 weeks.

On Jul. 28, ConocoPhillips shares rose over 2%, joining a broad rally in energy stocks as WTI crude oil prices climbed more than 2% to a one-week high. The sector-wide gains reflected renewed investor optimism tied to rising oil prices.

For fiscal 2025, ending in December, analysts expect diluted EPS to come in at $6.45, reflecting a 17.2% decline. Moreover, the company has managed to outperform bottom-line expectations in three of the last four quarters, while missing on another occasion.

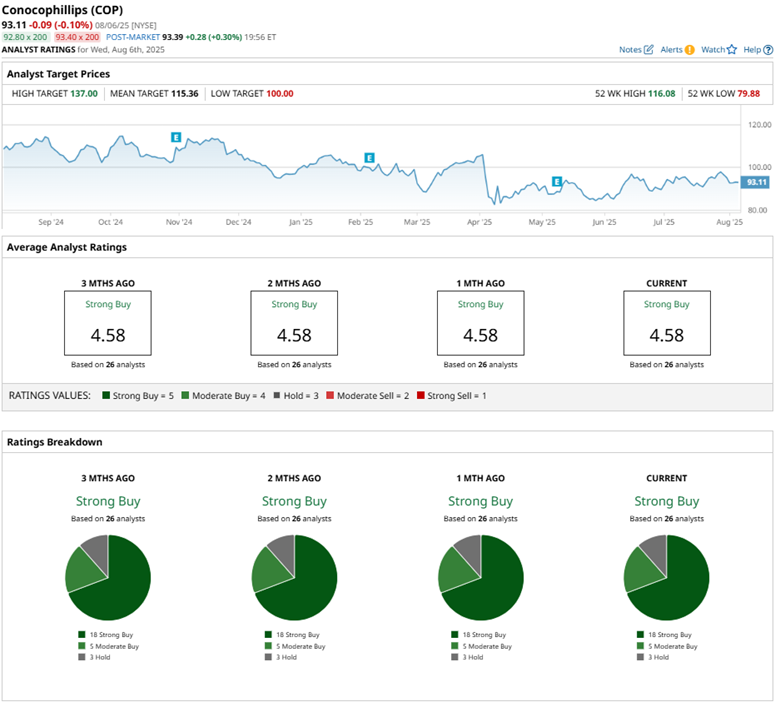

Nevertheless, among 26 analysts covering COP stock, the consensus rating is a "Strong Buy," comprising 18 "Strong Buy" ratings, five "Moderate Buys," and three "Holds."

The distribution mirrors same sentiment from three months ago, suggesting that analysts are holding their ground, even as the stock has stumbled.

UBS Group AG (UBS), for instance, recently raised its price target on COP from $111 to $115 last month, reaffirming its “Buy” rating. The firm pointed to a solid operational update in Q1 2025 but acknowledged that concerns about ConocoPhillips’ capital return program have been a drag on the stock. According to UBS, that overhang has now been addressed, or in their words, “this band-aid now ripped off.” The expectation is also that free cash flow will improve meaningfully in the second half of the year as long-cycle spending begins to taper off.

The mean price target of $115.36 represents a 23.9% premium to COP’s current price levels. Meanwhile, the Street-high price target of $137 suggests a potential upside of 47.1%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.