Do Wall Street Analysts Like Tyson Foods Stock?

Valued at a market cap of around $20 billion, Tyson Foods, Inc. (TSN) is one of the world’s largest food companies and the biggest U.S. chicken producer. The company offers a wide range of fresh and processed meat products under well-known brands like Tyson, Jimmy Dean, and Hillshire Farm.

Shares of the Springdale, Arkansas-based company have lagged behind the broader market over the past 52 weeks. TSN stock has dropped 8.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 21.1%. Moreover, shares of Tyson Foods are down 2.4% on a YTD basis, compared to SPX’s 7.9% return.

Narrowing the focus, shares of the meat producer have underperformed the Consumer Staples Select Sector SPDR Fund’s (XLP) 4.3% rise over the past 52 weeks.

Shares of Tyson Foods rose 2.4% on Aug. 4 after the company reported adjusted EPS of $0.91 and net sales of $13.9 billion, surpassing Wall Street’s expectations. The company also raised its fiscal 2025 revenue forecast to 2% - 3% growth and boosted its annual chicken income projection to $1.3 billion - $1.4 billion. Despite continued losses in the beef segment, Tyson’s strong chicken performance - 3.5% sales growth and 2.4% volume increase, helped reassure investors and drive the stock upward.

For the fiscal year ending in September 2025, analysts expect TSN’s EPS to grow 25.2% year-over-year to $3.88. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

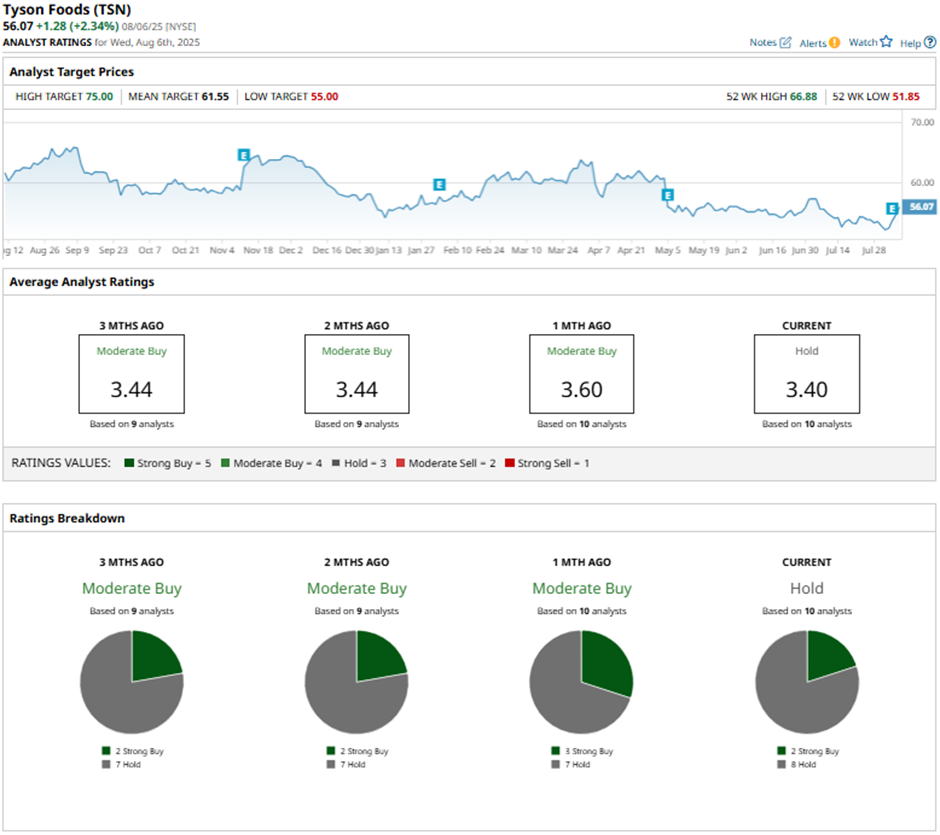

Among the 10 analysts covering the stock, the consensus rating is a “Hold.” That’s based on two “Strong Buy” ratings and eight “Holds.”

On Jul. 18, Bernstein analyst Alexia Burland Howard reaffirmed a “Buy” rating on Tyson Foods and set a price target of $74.

As of writing, the stock is trading below the mean price target of $61.55. The Street-high price target of $75 implies a potential upside of 33.8% from the current price.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.