Dear Ford Stock Fans, Mark Your Calendar for August 11

/Ford%20Motor%20Co_%20logo%20by-%20Vera%20Tikhonova%20via%20iStock.jpg)

Recently, Ford Motor (F) reported its second-quarter 2025 earnings, showing record revenue but only a modest profit amid rising costs. However, CEO Jim Farley used the call to tout a new electric vehicle strategy, announcing an Aug. 11 event in Kentucky to reveal “breakthrough electric vehicles in America.”

Farley called the announcement a “Model-T moment” for Ford, signaling a bold pivot toward affordable EVs.

The upbeat language comes as Ford’s top executives seek to reassure investors. Despite strong sales and an earnings beat, the company still faces headwinds from recalls, tariffs, and heavy R&D expenses.

For Ford stock fans, Aug. 11 is shaping up to be more than just a date. It is a potential turning point in the company’s EV future.

About Ford Stock

Ford is a global automobile manufacturer renowned for its extensive range of vehicles, including Ford trucks, sport utility vehicles, commercial vans, and luxury Lincoln models. The company maintains a strong presence in both domestic and international markets, with a deep legacy in innovation and mass manufacturing.

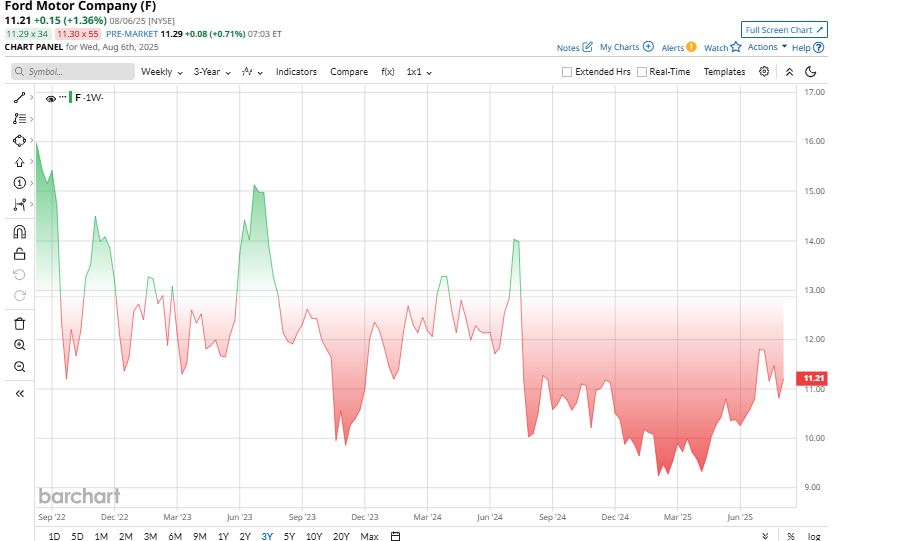

Valued at $44.6 billion by market cap, Ford’s stock has delivered an impressive 13% year-to-date gain, outpacing the broader S&P 500 Index ($SPX) 8.1% rise over the same period.

From a valuation standpoint, Ford appears attractively priced. It trades at a trailing price-earnings ratio of just under 8x, well below the sector median of 16x, signaling that shares may be undervalued relative to peers. Moreover, the company’s 5.4% dividend yield, double the sector average, adds an appealing income component for investors seeking value in the auto space.

Mark Your Calendar for August 11

A key focus for investors is Ford’s plan to revive its electric‑vehicle business, the very topic of the Aug. 11 event. Farley and the team have branded this upcoming announcement as a transformative “Model-T moment.” He explained that Ford will be in Kentucky to unveil “our plans to design and build a breakthrough electric vehicle and a platform in the U.S.” In other words, Ford is promising a new low-cost EV platform that can spawn multiple vehicles.

Ford is set to unveil plans for a new line of affordable EVs, developed by a secret team led by ex-Tesla (TSLA) talent. Aimed at the sub-$30,000 market, the initiative includes a rumored mid-size pickup and multiple vehicle styles to reverse EV losses and boost long-term profitability. This event could shape Ford’s stock in either direction.

Ford Beats Q2 Earnings Estimate

In its latest quarterly earnings, Ford topped expectations in terms of both revenue and earnings. Sales reached $50.2 billion, marking a 5% year-over-year increase and setting a new record for quarterly revenue. Adjusted earnings per share came in at $0.37, ahead of Wall Street’s estimate of around $0.31.

That said, Ford reported a modest net loss of $36 million, mainly due to one-time charges tied to recall and warranty costs, along with an $800 million tariff-related hit. Importantly, these weren’t signs of weakening demand. Excluding these items, adjusted EBIT remained solid at $2.1 billion.

On the positive side, Ford’s cash flow performance stood out. The company generated $6.3 billion in operating cash flow and $2.8 billion in adjusted free cash flow during the quarter. Ford ended Q2 with $28.4 billion in cash on hand and a total liquidity of $46.6 billion, giving it a sturdy financial cushion.

CFO Sherry House emphasized that this marks the fourth straight quarter of year-over-year cost improvements (excluding tariff impacts). Management also reaffirmed its full-year guidance, projecting adjusted EBIT between $6.5 billion and $7.5 billion for 2025, despite $2 billion in expected tariff headwinds.

What Do Analysts Say About Ford Stock?

Analysts offered a mixed but cautiously optimistic view on Ford. Bank of America maintained a “Buy” rating with a $14 price target, citing strong volume and pricing, despite a $400 million foreign exchange headwind.

Similarly, Goldman Sachs maintained a “Neutral” stance with an $11 target but noted that excluding the $2 billion in tariff-related costs, Ford’s core operations could deliver $9 billion in EBIT, above current guidance.

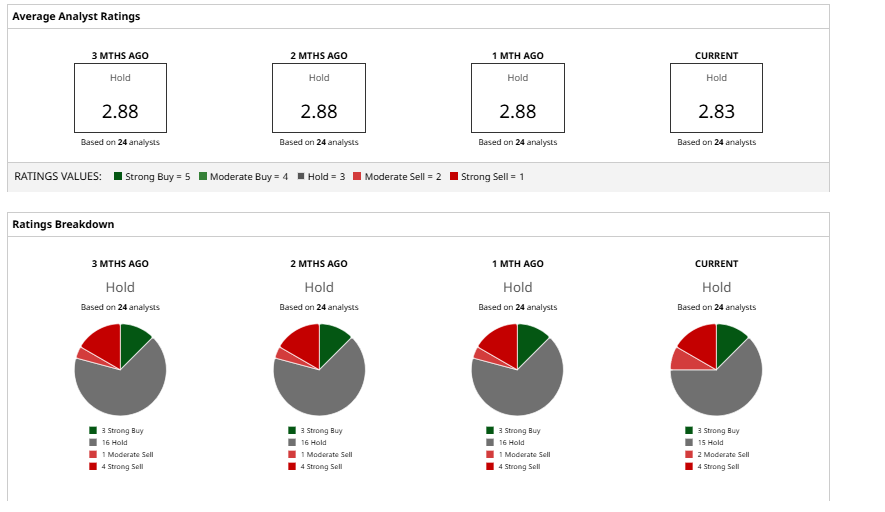

Overall, Wall Street analysts maintain a consensus “Hold” rating on Ford, with a mean price target of $10.33.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.