Earnings Season Winner: 1 Tech Stock That Just Gained Big Momentum

/Facebook%20on%20a%20phone%20by%20Firmbee_com%20via%20Unsplash.jpg)

Meta Platforms (META) has emerged as a dominant force this earnings season, reporting record-breaking second-quarter results that highlight the company’s strength as a technology and artificial intelligence leader.

While many companies are still experimenting with artificial intelligence, Meta is already working toward what CEO Mark Zuckerberg refers to as "personal superintelligence," which he defines as “AI that surpasses human intelligence in every way.”

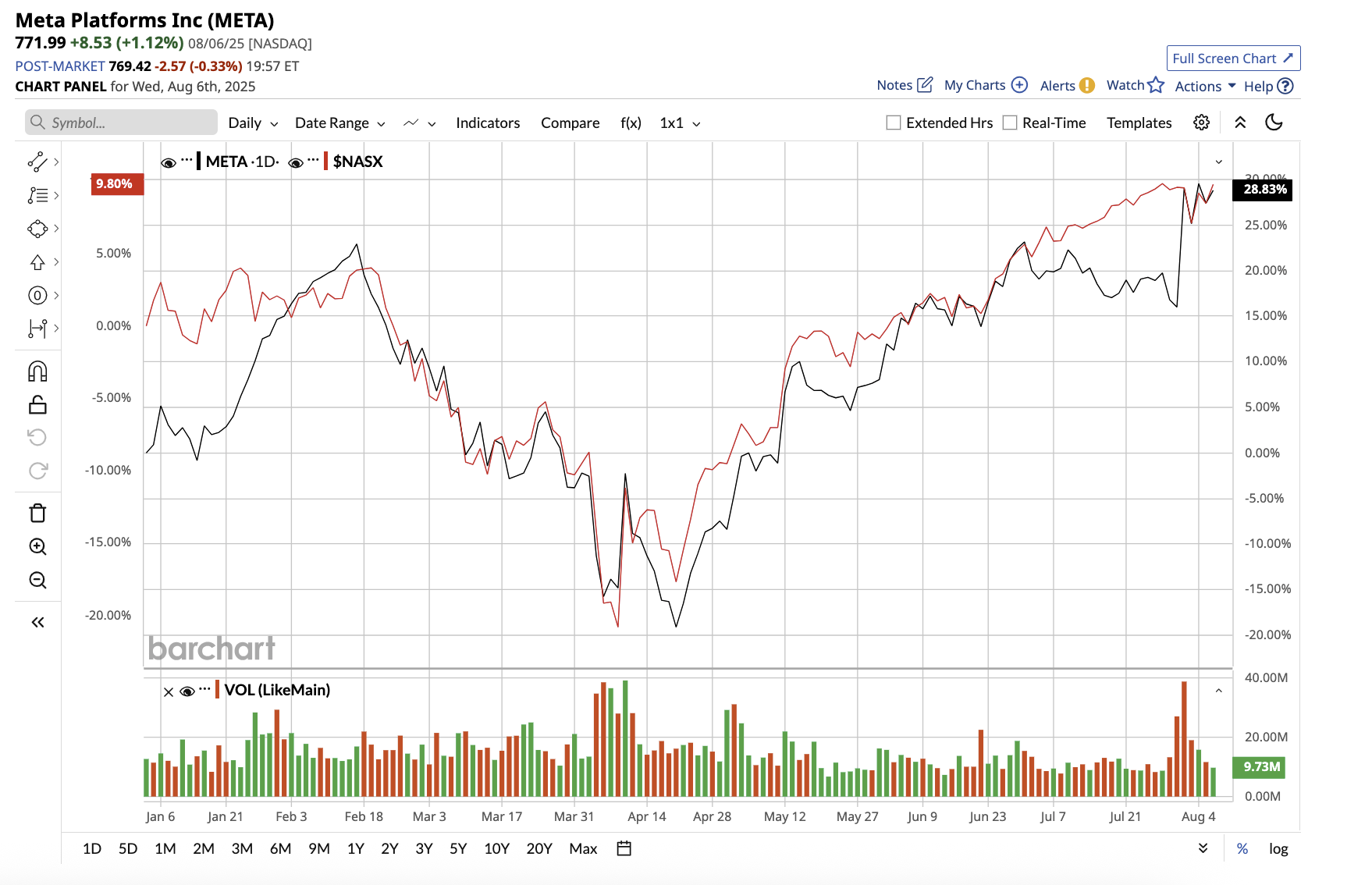

Meta stock has surged 31.6% year-to-date, surpassing most tech players in the Magnificent Seven group and even the tech-heavy Nasdaq Composite Index ($NASX) gain of 10.3%. Let’s find out if it is a good time to grab Meta stock.

Meta Reported a Blockbuster Quarter

With 3.4 billion people using one of its apps on a daily basis, including Facebook, Instagram, WhatsApp, Messenger, and Threads, Meta continues to shape the digital and AI revolution. The company delivered a record-breaking quarter, thanks to increased engagement across its platforms, increased ad revenue, transformative AI features, and the early monetization of its next-generation products. Meta’s total revenue climbed 22% year-over-year to $47.5 billion. Diluted earnings increased 38% to $7.14 per share.

The Family of Apps (FoA) segment, which includes all social media platforms, is thriving, with revenue up 21.8% year-over-year to $47.1 billion. Meta AI, the company’s AI assistant, now powers interactions on Facebook, Instagram, and, most importantly, WhatsApp, where it is most frequently used. Management emphasized that Meta AI is quickly integrating itself into the daily habits of users all over the world, from image generation and homework help to content discovery and even post-analysis. While Threads is still relatively new and has a low ad supply, Meta is beginning to monetize it.

Advertising revenue for FoA increased by 21% to $46.6 billion. Online commerce was the largest driver of ad growth. The company’s Advantage+ suite of AI tools is popular among advertisers.

Notably, Meta’s generative video tools, such as Image Animation and Video Expansion, are used by nearly 2 million advertisers, and its text generation capabilities are also seeing solid engagement.

The Reality Labs (RL) segment, which includes augmented and virtual reality, saw a 4.8% increase in revenue to $370 million. This growth was fueled by the adoption of AI glasses and the release of new products such as the Meta Quest 3S Xbox Edition. Losses widened slightly, with an operating loss of $4.5 billion. Meta continues to invest heavily in this segment, believing that immersive computing, including XR and wearable AI, will be an essential component of the future AI-human interface.

Aggressive Capital Allocation to Build Long-Term Moat

Meta ended the quarter with $47.1 billion in cash and marketable securities and $28.8 billion in debt. It also generated $8.5 billion in free cash flow, distributed $1.3 billion in dividends, and repurchased $9.8 billion in shares. Meta is investing heavily in its future. The company expects capital expenditures of $66 billion to $72 billion in 2025, with a similar sharp increase in 2026. Management stated that this capital is being primarily invested in AI infrastructure, such as compute capacity and data center expansion.

These investments are not just to keep up with AI competitors. They are focused on establishing long-term competitive advantages in AI model development, platform intelligence, and operational scale. Analysts expect Meta’s earnings to rise by 16.5% in 2025, followed by another 6.7% in 2026. Meta is slightly overvalued, trading at 27 times forward-estimated 2025 earnings.

What Does Wall Street Say About Meta Stock?

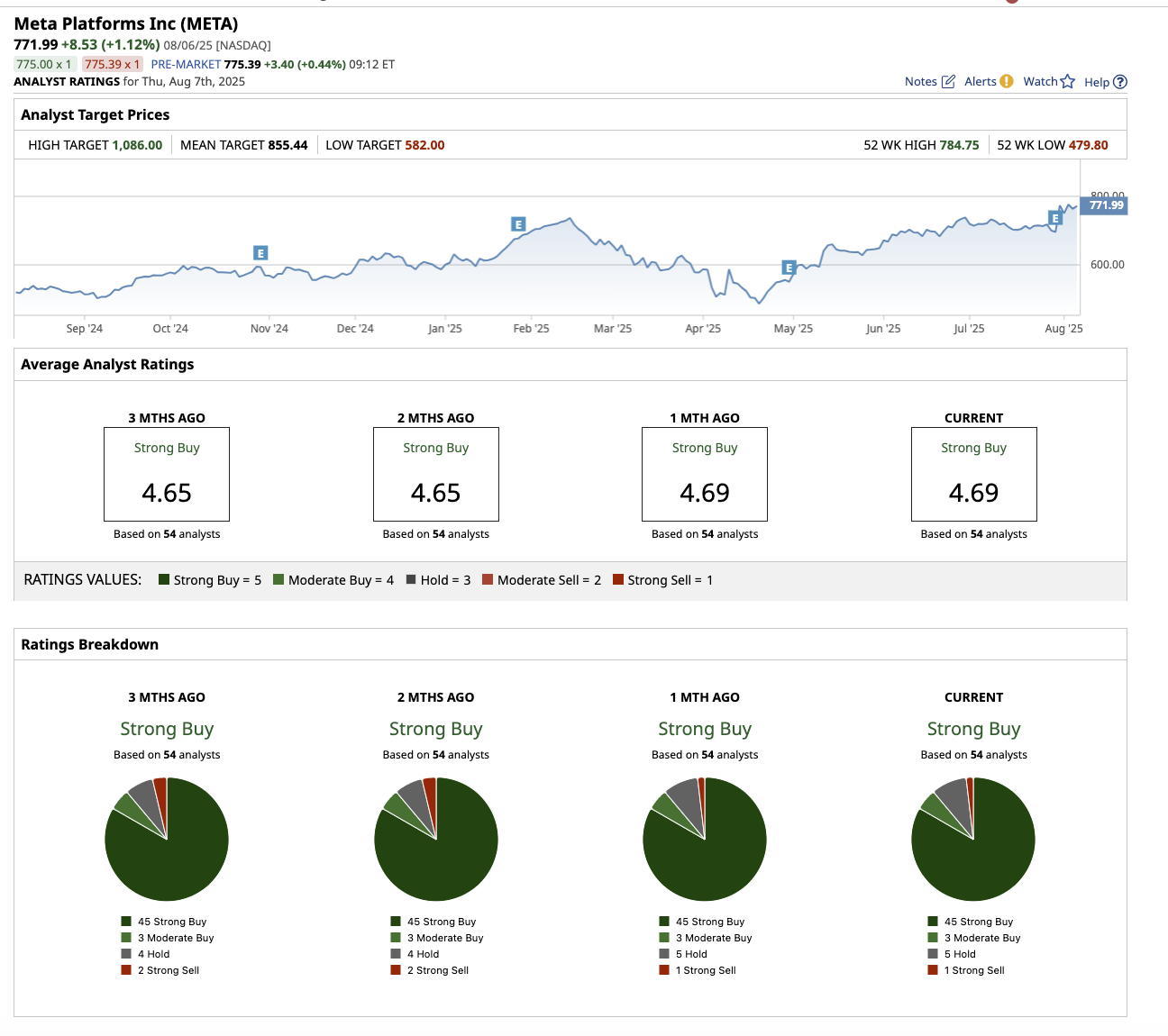

Overall, the consensus for META stock is an overall “Strong Buy.” Among the 54 analysts covering the company, 45 give it a “Strong Buy” rating, three recommend a “Moderate Buy,” five suggest holding, and one rates it a “Strong Sell.” The average price target of $855.44 indicates potential 11% upside from current levels. Meanwhile, the high price target of $1,086 implies the stock could surge by as much as 41% over the next year.

The Bottom Line on META Stock

Meta is more than just a social media platform, with new revenue engines such as Threads, business messaging, and Ray-Ban Meta smart glasses gaining traction, as well as a strong commitment to AI infrastructure. Investors seeking a long-term, AI-powered growth story with strong monetization, deep engagement, and a bold AI vision may find Meta to be one of the most appealing tech stocks in the market right now. However, given that META is trading at a premium, risk-averse investors may want to accumulate shares in the $680 to $690 range to invest with a margin of safety.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.