1 ‘Strong Buy’ Stock Analysts Think Will Soar 62%

Valued at $21.4 billion, Natera (NTRA) is a clinical genetic testing company focused on non-invasive cell-free DNA (cfDNA) testing across three main areas: women’s health, oncology, and organ health. In its recent second-quarter results, Natera showed no signs of slowing down.

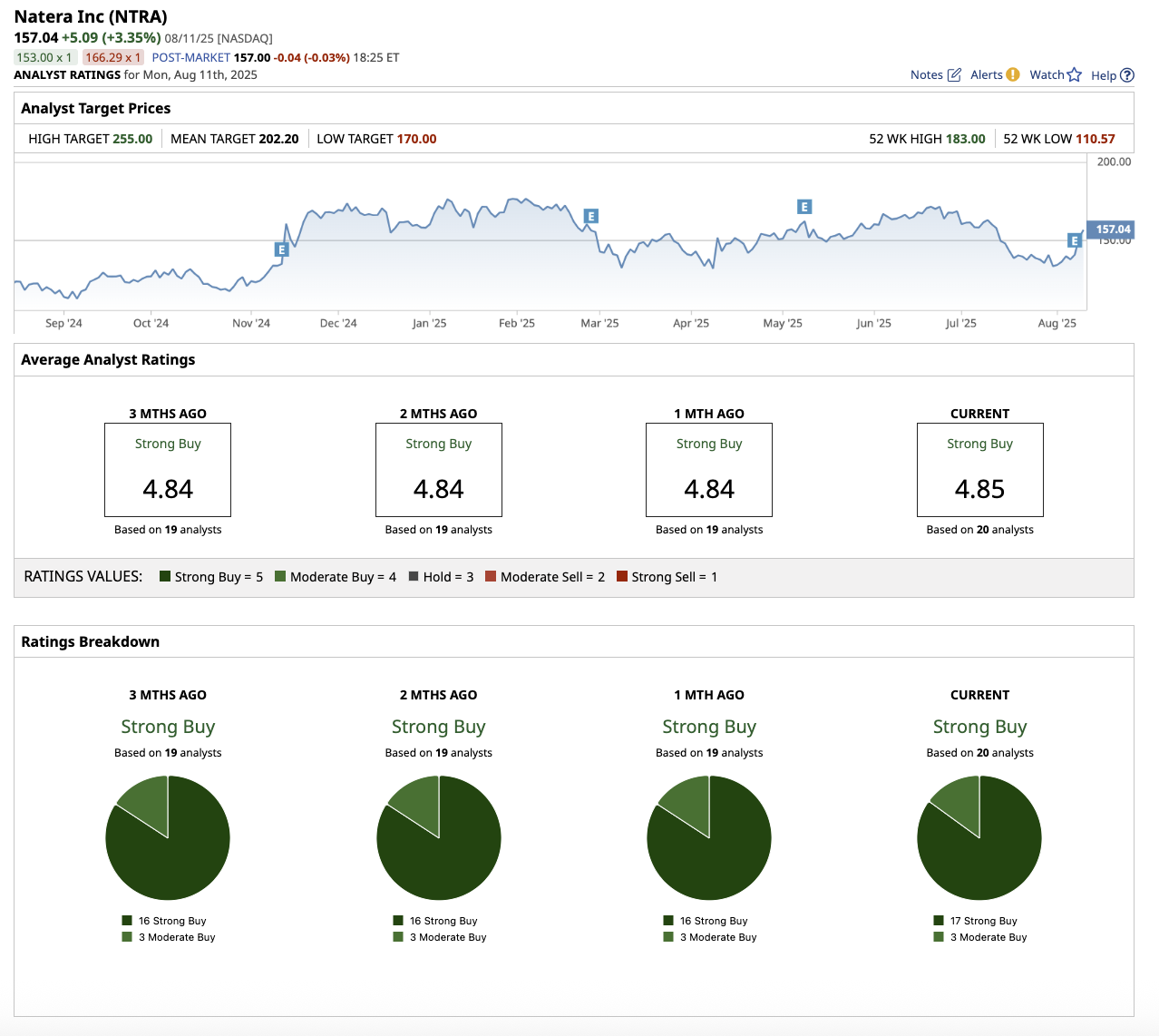

Wall Street is bullish on the stock due to new product launches, landmark clinical trial results, and increased adoption of its precision diagnostics technology. Overall, analysts rate it a “Strong Buy,” expecting a 62% increase from current levels based on the Street-high estimate. Natera stock is up 0.7% year-to-date, compared to the 9% broader market gain, making it a good time to grab this growth stock while it underperforms.

Natera’s Growth Story Hits a New Gear

In the second quarter, Natera reported $547 million in revenue, marking a 32% year-over-year increase, with product revenue up 32.2%. This impressive top-line growth was driven by robust volume expansion throughout the portfolio. Notably, in oncology, Signatera, Natera’s personalized, tumor-informed ctDNA test, which monitors cancer recurrence and treatment response, has reached an all-time high. The company processed 189,000 oncology tests in the quarter, nearly 20,000 more than in Q1, breaking its previous sequential growth record. During the Q2 earnings call, management emphasized that Signatera’s rapid adoption is not limited to colorectal cancer, breast cancer, and immuno-oncology monitoring. In fact, physicians are increasingly using Signatera for a wider range of tumor types.

Natera believes that this trend will have a transformative revenue impact in the future, as the company is actively seeking Medicare reimbursement for this “longer tail of cancers.” Based on current growth rates, the company estimates that securing coverage for these uncovered indications could increase revenue and gross profit by $253 million per year, bringing Signatera closer to its $2,000 ASP target. Gross margins increased to 63.4%, up from 59% the year before.

Natera does not rely on a single product to drive growth. The company is actively expanding in three key areas: oncology, women’s health, and organ health. In fetal medicine, the company introduced a new non-invasive prenatal test (NIPT) for inherited conditions. It also introduced Signatera Genome, an expanded version of the MRD test, and single-gene NIPT, a prenatal innovation that targets specific genetic disorders.

Natera believes early cancer detection (ECD) is a lucrative long-term opportunity. The PRECIDE trial, which targets advanced adenoma detection via colonoscopy, now has over 3,500 patients enrolled, with a readout expected this year. In addition, the FDA-approved FIND trial is currently underway. Natera plans to release additional oncology data in Q3, including results from the INVIGOR-01 bladder cancer trial. The company also hinted that AI-powered foundation models would power the next generation of early cancer detection tools.

Raising the Bar for 2025

Given the strong momentum, Natera increased its full-year revenue guidance by $80 million to a range of $2.02 billion to $2.1 billion, in line with analysts’ expectations. Gross margin guidance has also been updated to a range of 61% to 64%, reflecting operational efficiencies, pricing strength, and a favorable product mix. Management sees few drivers for future margin expansion, such as lower test production costs and reduced manual work through the use of artificial intelligence (AI)-based foundation models to streamline operations without sacrificing quality.

Furthermore, coverage expansion through new reimbursement wins for oncology, carrier screening, organ health, and specific genetic conditions may increase margins. Natera reiterated its cash flow positive outlook for 2025, with investments in clinical trials and AI expected to drive growth in 2026 and beyond. With over 100 clinical trials underway, multiple new product launches, and early cancer detection on the horizon, Natera appears to be well-positioned for double-digit growth. This makes Natera stock an attractive option for long-term investors.

What Is the Target Price for Natera Stock?

The average target price of $202.2 suggests the stock can climb as much as 27% from current levels. The high price estimate of $255 implies upside potential of 62.4% over the next 12 months. Among the 20 analysts covering the stock, 17 rate it a “Strong Buy,” and three rate it a “Moderate Buy.”

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.