What Are Wall Street Analysts’ Target Price for Phillips 66 Stock?

Phillips 66 (PSX) is a multinational company in the energy sector, operating primarily in the Oil & Gas Refining and Marketing industry. Headquartered in Houston, Texas, it was formed in 2012 when ConocoPhillips spun off its downstream operations. The company is involved in refining crude oil (CLU25), transporting and marketing natural gas liquids (NGLs), petrochemicals, and fuel products, and it co-owns the Chevron Phillips Chemical joint venture. Phillips 66’s market cap stands at approximately $48.5 billion.

Phillips 66 has surged by 5.4% on a year-to-date (YTD) basis, slightly trailing the broader benchmark S&P 500 Index’s ($SPX) growth of around 9.6%. Over the past 52 weeks, PSX has declined 11.7%, versus SPX’s returns of 20.6%.

Narrowing the focus, the Energy Select Sector SPDR ETF (XLE) has recorded a more subdued performance with a decline of 1.2% YTD and 5.8% over the past year, suggesting energy-sector investors remain cautious.

The modest outperformance of PSX relative to XLE this year points to company-specific strengths, namely elevated refining efficiency rates, helping to buoy the stock amid a broadly underperforming sector.

Meanwhile, PSX lagging behind the broader market likely reflects persistent pressure on energy valuations, driven by structural shifts toward tech and renewables, tariff-related input cost concerns, and continued capital rotation away from traditional oil & gas, factors that may dampen sentiment toward energy exposures overall.

For the current fiscal year, ending in December 2025, analysts expect Phillips 66's EPS to decline by 23.6% year-over-year to $4.70, on a diluted basis. The company’s record of beating earnings is a mixed bag, surpassing EPS forecasts in three of the last four quarters, while missing on one other occasion.

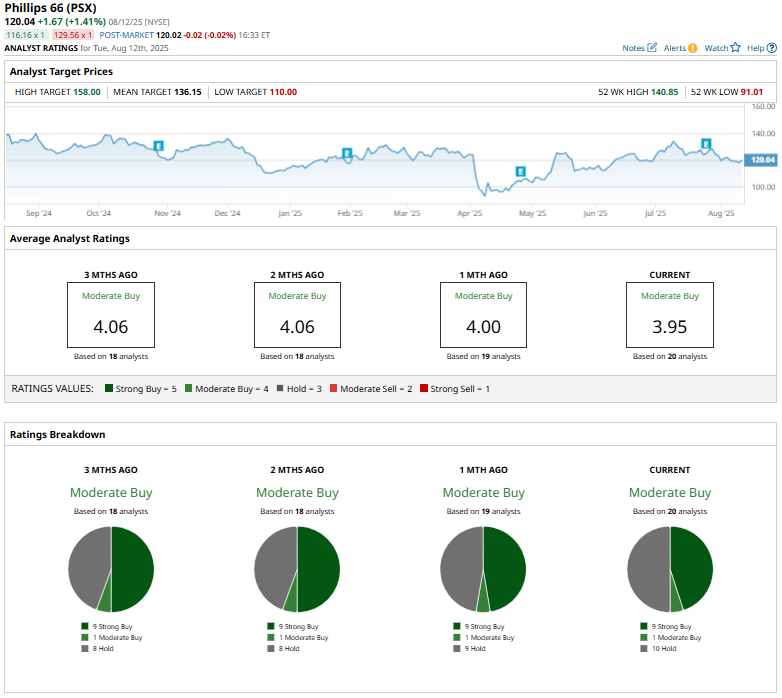

Out of the 20 analysts covering PSX stock, the consensus rating is a “Moderate Buy.” That’s based on nine analysts recommending a “Strong Buy,” one advising a “Moderate Buy,” and the remaining 10 staying cautious with a “Hold” rating.

The current configuration has remained largely consistent over the past few months.

On July 28, TD Cowen raised PSX's price target to $134 from $130 while maintaining a “Buy” rating, citing strong refining performance and cost-efficiency improvements in the most recent quarter.

The mean price target of $136.15 represents that PSX stock could rally as much as 13.4%. Meanwhile, the Street-high price target of $158 suggests an upside potential of 31.6%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.