Lucid vs. Rivian: Which EV Challenger Is the Better Stock to Buy Now?

/Electric%20car%20being%20recharged%20by%20Choochart%20Choochaikupt%20via%20iStock.jpg)

As traditional automakers continue to transition to electric vehicles (EVs), pure-play EV challengers such as Lucid Group (LCID) and Rivian Automotive (RIVN) compete for market share in an industry that remains highly volatile.

Both companies have compelling technology, ambitious expansion plans, and clearly defined target markets, but they also face similar profitability challenges and policy headwinds. Both have just released their second-quarter results, which show both promise and pressure. Let’s find out which is the better buy right now.

The Bull Case for Lucid Stock

Lucid reported $259 million in Q2 revenue, a 29% increase year over year, and the sixth consecutive quarter of record deliveries (3,309 units). Production increased to 3,863 vehicles, up 38% from the same period last year. Lucid expects to produce between 18,000 and 20,000 vehicles this year. However, its gross margin was negative 105%, weighed down by a $54 million tariff impact. Lucid reported an adjusted net loss of $0.24 per share.

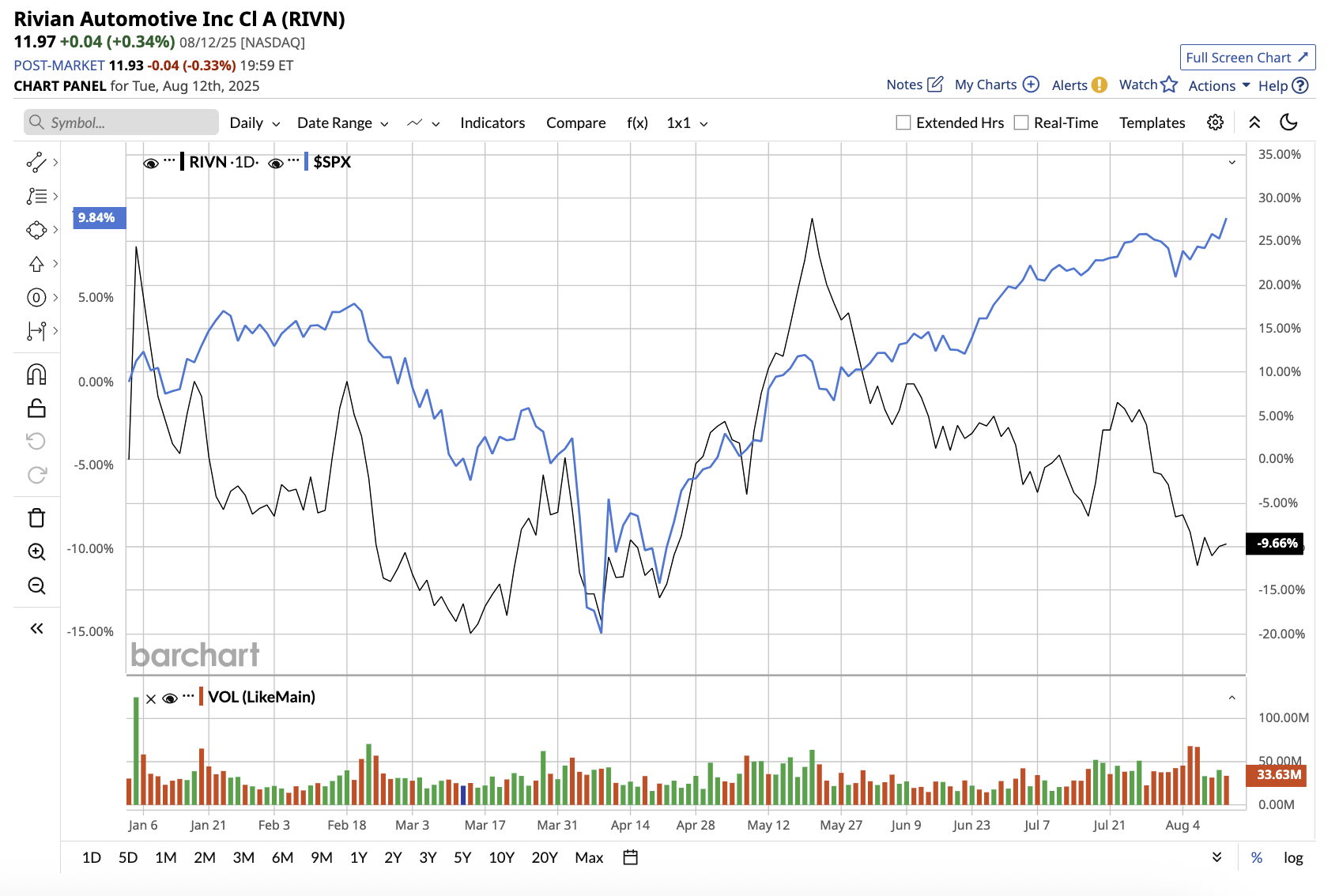

Lucid stock is down 25% year-to-date, compared to the broader market gain of 9.7%. Lucid announced plans for a 1-for-10 reverse stock split, which is expected in early September pending shareholder approval. Management claims it is intended to attract long-term institutional investors.

Its flagship Air sedan continues to receive praise for its market-leading range, high efficiency, and ultra-fast charging abilities. These features have given Lucid a technological advantage in the luxury EV segment. Additionally, the Gravity SUV has the potential to significantly expand Lucid’s addressable market and increase sales volumes.

The most notable move this quarter was Lucid’s recently announced partnership with Uber (UBER) in Europe to develop a next-generation premium robotaxi based on the Lucid Gravity platform. The agreement includes a $300 million Uber investment in Lucid (pending regulatory approval) and the deployment of 20,000 Lucid Gravity robotaxis over six years, with the first vehicles expected to launch in late 2026. For investors, this represents a potentially massive entry point into the multitrillion-dollar robotaxi market, as well as a third-party validation of Lucid’s engineering capabilities.

Furthermore, Lucid’s strong liquidity position can be attributed primarily to ongoing investments from Saudi Arabia’s Public Investment Fund. This deep-pocketed backing reduces Lucid’s near-term bankruptcy risk and allows the company to continue developing new models and scaling production even as profitability remains elusive. Despite sector headwinds, Lucid ended the second quarter with $3.6 billion in cash and investments and $4.86 billion in total liquidity. The company’s Uber partnership, reverse split, and supply chain localization all point to a strategy aimed at diversifying revenue streams, improving institutional investor appeal, and protecting margins in a tariff-heavy environment.

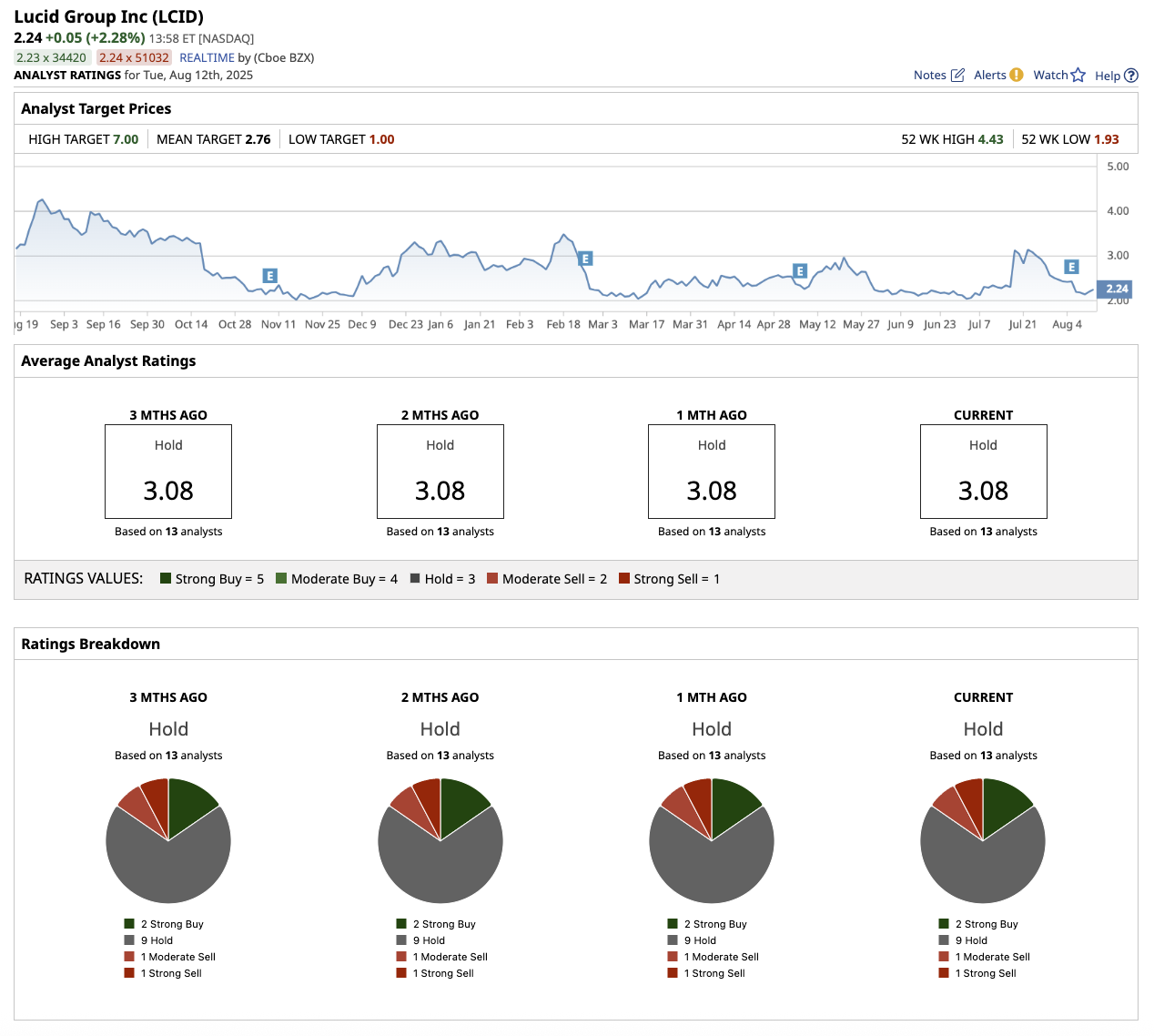

Overall, on Wall Street, Lucid stock is a “Hold.” Among the 13 analysts that cover the stock, two rate it a “Strong Buy,” nine say it is a “Hold,” one says it is a “Moderate Sell,” and one rates it a “Strong Sell.” The stock is trading close to its average target price of $2.76. The high price estimate of $7 implies upside potential of 214% over the next 12 months.

The Bull Case for Rivian

In the second quarter, Rivian produced 5,979 vehicles and delivered 10,661, generating $1.3 billion in total revenue. Automotive revenue reached $927 million, but production volumes fell compared to the first quarter due to supply chain complexities. The adjusted EBITDA losses totaled $667 million. Rivian stock is down 9.3% year-to-date, compared to the overall market.

Rivian’s biggest near-term catalyst is the mid-size R2 platform, which will go into production in 2026. CEO RJ Scaringe calls it the “best product we’ve ever developed,” with broad market appeal, competitive packaging, and compelling technological integration. Along with R2, Rivian launched its R1 Quad Motor variant last month, which, according to management, has received positive feedback from customers and industry media. Rivian is also betting heavily on autonomy with its Rivian Autonomy Platform, viewing it as a necessary feature for future competitiveness.

Beyond vehicle sales, Rivian’s Software and Services segment is rapidly expanding, generating $376 million in Q2 revenue with strong margins, aided by a joint venture with Volkswagen Group (VWAGY). Rivian’s balance sheet was strengthened by a recent $1 billion equity investment from VW at a 33% premium to the market. Rivian ended the quarter with $7.5 billion in liquidity and anticipates additional funding from its VW joint venture and a Department of Energy loan for its Georgia facility. Management has identified increased tariffs as a near-term profitability headwind and is pursuing tariff mitigation strategies.

The company reaffirmed its 2025 delivery guidance of 40,000 to 46,000 vehicles, as well as its capital expenditure guidance of $1.8 billion to $1.9 billion. Q3 is expected to be the busiest delivery quarter of the year. However, adjusted EBITDA losses are now expected to be $2.0 billion to $2.25 billion as a result of regulatory changes, including a reduction in EV credit revenue forecasts from $300 million to $160 million.

The R2’s market debut, as well as Rivian’s growing autonomy capabilities, demonstrate that the company is pursuing rapid growth. However, how the company handles policy changes, supply chain risks, and profitability pressures are indicators investors should keep an eye out for in the coming quarters.

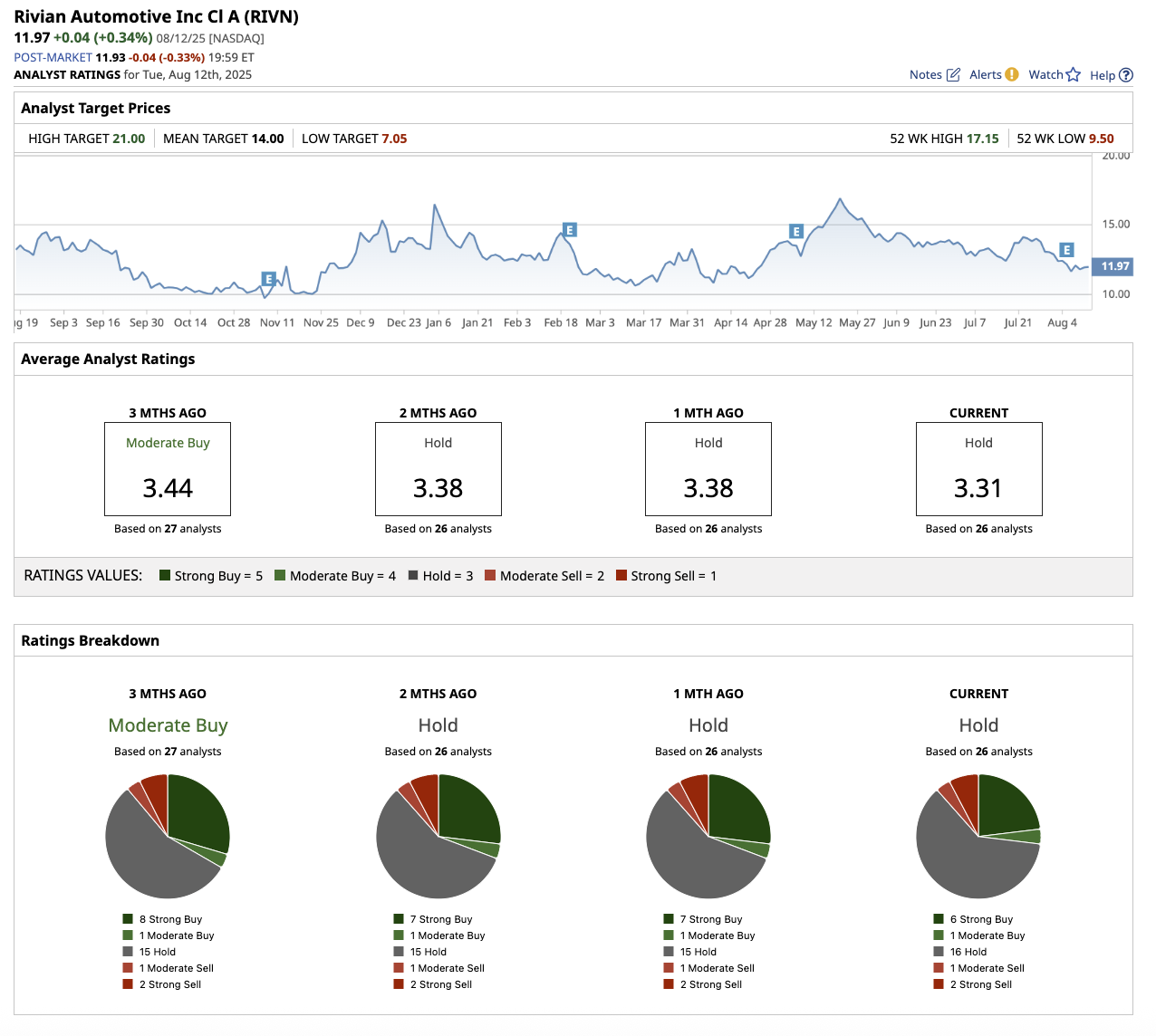

Overall, on Wall Street, Rivian stock is a “Hold.” Among the 26 analysts that cover the stock, six rate it a “Strong Buy,” one says it is a “Moderate Buy,” 16 rate it a “Hold,” one says it is a “Moderate Sell,” and two advise a “Strong Sell.” The average target price of $14 implies the stock can surge 18.7% from current levels. The high price estimate of $21 implies upside potential of 78.1% over the next 12 months.

The Bottom Line: Which Is the Better Stock to Buy?

Rivian may have an advantage for investors looking for near-term product expansion and stronger balance sheet diversification, especially since the R2 platform is poised to target a broader, higher-volume segment than Lucid’s luxury niche. However, for those betting on premium brand dominance and efficiency leadership in the luxury EV space, Lucid remains a unique high-risk, high-reward opportunity.

Nevertheless, both stocks are likely to remain volatile until profitability visibility improves, so investors with a long-term horizon should consider buying positions based on their risk appetite.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.