Clorox Stock: Is Wall Street Bullish or Bearish?

The Clorox Company (CLX) is a California-based consumer goods manufacturer best known for its cleaning, disinfecting, and household products, including well-known brands such as Clorox bleach, Pine-Sol, Glad, and Burt’s Bees, which serve both domestic and international markets. With a market cap of $15 billion, the company operates through Health and Wellness, Household, Lifestyle, and International segments.

CLX has notably underperformed the broader market over the past year and in 2025. CLX’s stock prices have decreased 14.4% over the past 52 weeks and 24.3% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 19% gains over the past year and a 10% rise in 2025.

Narrowing the focus, CLX has also underperformed the Consumer Staples Select Sector SPDR Fund’s (XLP) 4.5% rise over the past 52 weeks and its 5.1% uptick on a YTD basis.

On Jul. 31, Chlorox announced its fiscal fourth-quarter results, and its shares dipped 2% in the next trading session. Its adjusted EPS of $2.87 and revenue of $1.99 billion surpassed Wall Street expectations. Gross margin held steady at 46.5%, buoyed by higher volume and cost-saving measures, despite pressure from rising manufacturing, logistics, and trade promotion costs.

For the current fiscal year, ending in June 2026, analysts expect CLX’s adjusted EPS to fall 21.6% year over year to $6.05. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates thrice over the past four quarters, it missed the projections on one other occasion.

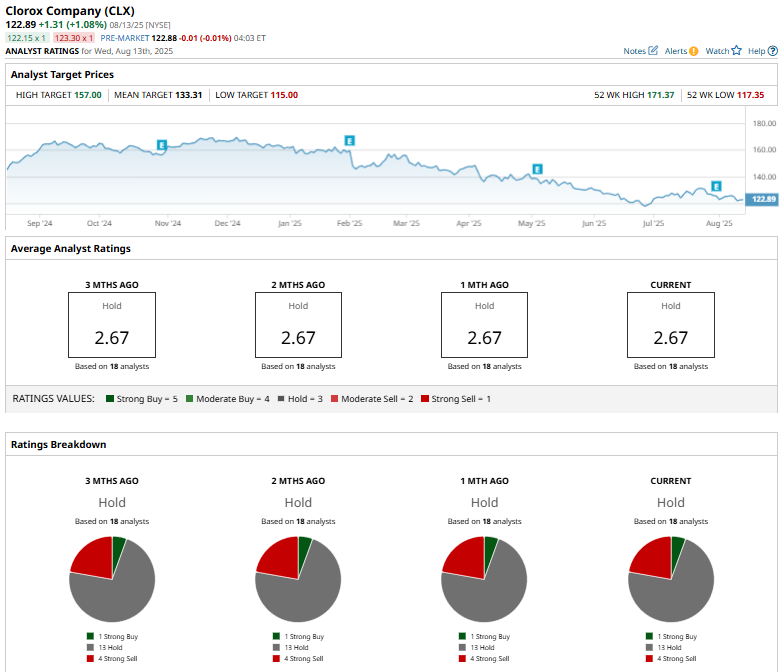

Meanwhile, CLX has a consensus “Hold” rating overall. Of the 18 analysts covering the stock, opinions include one “Strong Buy,” 13 “Holds,” and four “Strong Sells.”

This configuration has remained mostly stable in recent months.

On Aug. 2, Morgan Stanley’s (MS) Dara Mohsenian maintained an “Equal-Weight” rating on Clorox but cut the price target from $150 to $137.

CLX's mean price target of $133.31 implies a modest 8.5% premium to current price levels, while the Street-high target of $157 suggests a notable 27.8% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.