This Under-the-Radar Chip Stock Looks Like a Screaming Buy After Earnings

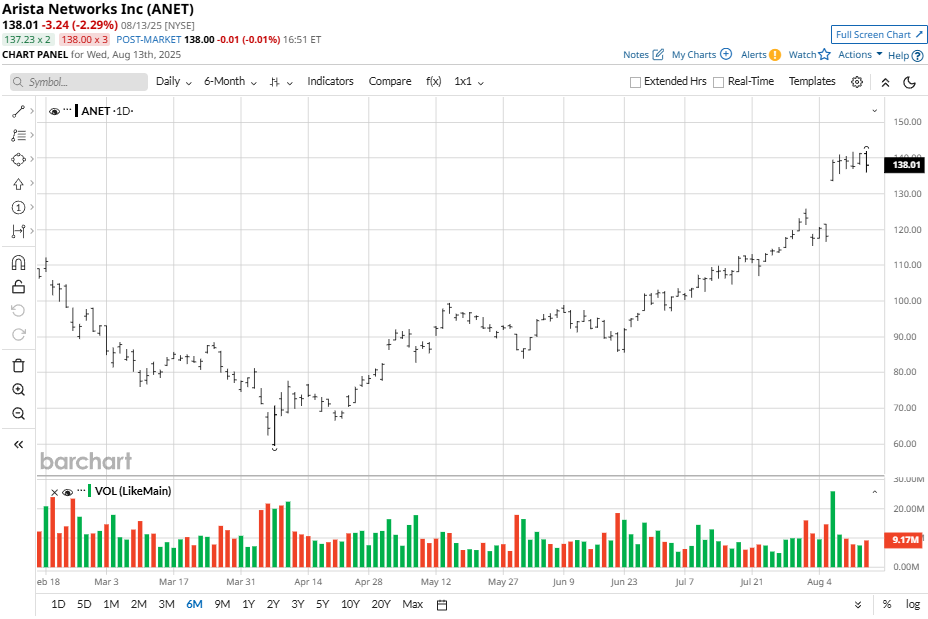

Arista Networks (ANET) is on a tear higher, gaining close to 130% from its lows set in April, leading to a 24% gain in the year to date. Over the last 12 months, Arista stock surged 57% against the benchmark S&P 500 Index’s ($SPX) 18.5% gain, reflecting investor confidence.

So why is ANET stock trading at its highs, and how should investors approach shares here?

Arista Networks’ Q2 Results

Arista Networks specializes in networking solutions for data centers and other enterprise clients. The company is known for its high-performance switching platforms, advanced automation, analytics, and security capabilities.

Arista Networks reported a record-breaking Q2 2025, with revenue jumping 30.4% year-over-year to $2.2 billion, beating analyst estimates of $2.11 billion. Non-GAAP EPS reached $0.73, exceeding the expected $0.65, while non-GAAP net income surged 37.3% to $923.5 million.

Non-GAAP operating margin improved to 47%, and operating income surpassed $ 1 billion for the first time, underscoring exceptional efficiency and scale. Growth was broad-based, with AI networking revenue on track to exceed $1.5 billion in 2025, including $750 million from backend Ethernet for hyperscale customers like Meta (META) and Microsoft (MSFT). Gross margins were robust, with non-GAAP gross margin at 65.6% and GAAP gross margin at 65.2%, both up from last year.

Looking ahead, Arista raised its annual growth target to 25%, aiming for $8.75 billion in 2025 revenue, up from prior guidance of 17%. Management expects the third quarter to deliver $2.25 billion in revenue, a non-GAAP gross margin around 64%, and operating margins near 47%. The company’s leadership highlighted growing enterprise adoption, rapid hyperscale deployments, and a unique “once-in-a-lifetime opportunity” to accelerate revenue momentum.

Arista is now targeting $10 billion in revenue in 2026, two years ahead of schedule, powered by AI, cloud, and campus networking tailwinds.

Analyst Takes on ANET

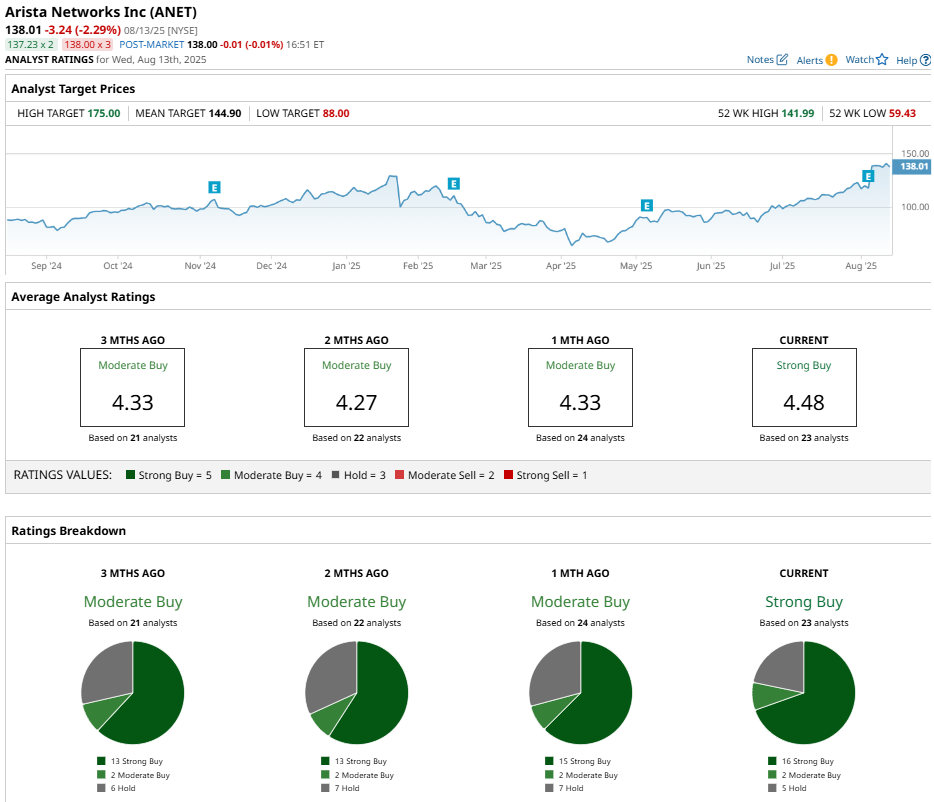

Analysts responded enthusiastically to Arista’s results and revised guidance. The consensus view is overwhelmingly positive, with major investment banks such as Barclays and Bank of America raising both ratings and price targets, applauding Arista’s execution, innovation, and market expansion. The increase in deferred revenue and scale of AI customer growth led JPMorgan and Morgan Stanley to reinforce their bullish outlooks. Technical ratings have been upgraded as the company challenges all-time highs, with analysts forecasting further upside given sustained margin growth, robust TAM expansion, and ongoing hyperscaler capex cycles.

The stock has a consensus “Strong Buy” rating and a mean price target of $144.90, reflecting 5% upside. It has been reviewed by 23 analysts, receiving 16 “Strong Buy” ratings, two “Moderate Buy” ratings, and five “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.