This Penny Stock Is Betting Big on the Animecoin Crypto. Should You Buy It Here?

Penny stocks often offer high-risk, high-reward opportunities for investors willing to bet on emerging trends before they hit the mainstream. These low-priced shares can deliver explosive gains if the underlying company executes well and capitalizes on a fast-growing market. One such intriguing play right now is GameSquare (GAME), which is making a bold pivot into the world of cryptocurrency and Web3.

The company recently announced it will add Animecoin (ANIME-USD), a digital asset tied to anime production and Web3 strategy, to its treasury as part of a $2.5 million revenue agreement. In addition, GameSquare will serve as the agency of record for the Animecoin Foundation, helping to expand its global reach and strengthen its presence in the gaming sector.

For investors seeking speculative upside in digital assets and niche entertainment markets, GAME’s latest move could be worth a closer look.

About GAME Stock

Based in Texas, GameSquare is a small-cap media and technology company focused on reaching Gen Z and Millennial audiences through gaming and entertainment channels. It owns assets like FaZe Clan (a major esports team) and Stream Hatchet (a live-stream analytics firm) and operates an Ethereum-based (ETHUSD) treasury program to earn on-chain yields.

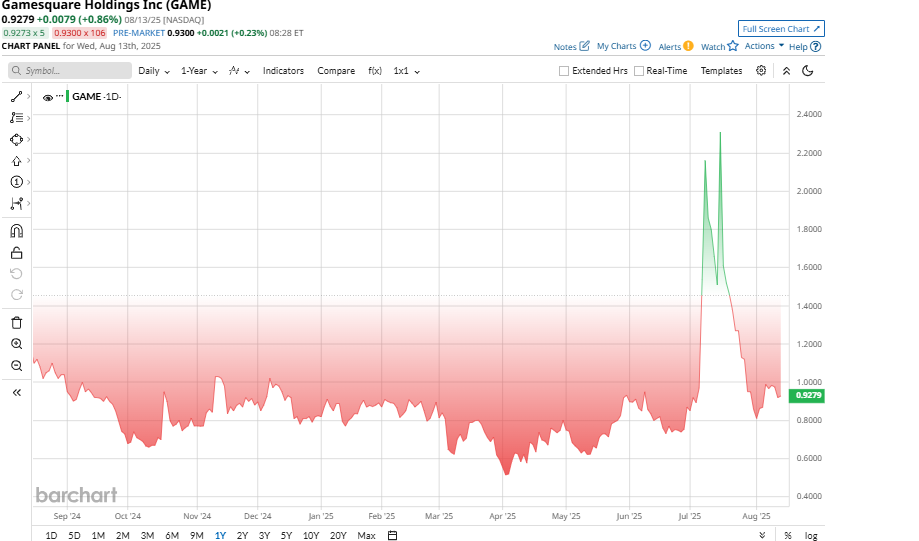

GameSquare is a highly speculative penny stock, hitting a low of $0.50 in April 2025 before rebounding to around $0.90–$0.95 by mid-August. Shares remain volatile, with a 48% drop over the past month, still up 12% YTD.

However, the company valuation looks pretty attractive for now, with a Price/Sales ratio of 0.32. That's significantly less expensive than the sector median of 1.27. This suggests the stock is undervalued compared to its peers.

What This Partnership Means for GAME’s Web3 Push

GameSquare's new Animecoin Foundation strategic partnership will be fundamental in expanding its Web3 presence. The company will purchase up to $2.5 million in Animecoin and act as the token’s marketing “agency of record” for one year, receiving $2.5 million in Animecoin for creative and promotional services. Valued at about $180 million fully diluted, Animecoin targets fans of both anime and gaming. The deal provides GameSquare with immediate revenue, diversifies its digital asset holdings, and offers upside if Animecoin’s value rises.

The Animecoin partnership is synergistic with GameSquare’s strategy: it adds a new revenue opportunity and puts a promising digital asset on the balance sheet. If Animecoin’s price rises, the treasury holding could appreciate, adding to shareholder value. GameSquare will also gain from marketing fees and cross-promotion, potentially raising its gaming and anime reputation.

Financial Snapshot & Outlook

In Q1 2025, GameSquare reported revenue of $21.1 million, up from $17.7 million a year earlier, with a net loss of $5.2 million. The company reiterated full-year 2025 guidance of $100-105 million in revenue and a gross margin of 20–25%. Management also expects to cut operating expenses by about $15M from 2024 levels, aiming to achieve positive EBITDA and cash flow in the second half of 2025.

Notably, GameSquare’s next quarterly report (Q2 2025) is due on Aug. 14, 2025, after the market close. Analysts generally expect continued losses (the stock is unprofitable on current figures), but the company has emphasized that rising revenues and cost cuts should narrow losses. For example, the recent Ubisoft (UBSFY) partnership (Stream Hatchet is working on Rainbow Six Siege X) is forecast to add to 2025 revenue.

Analyst's Opinion and Final Words

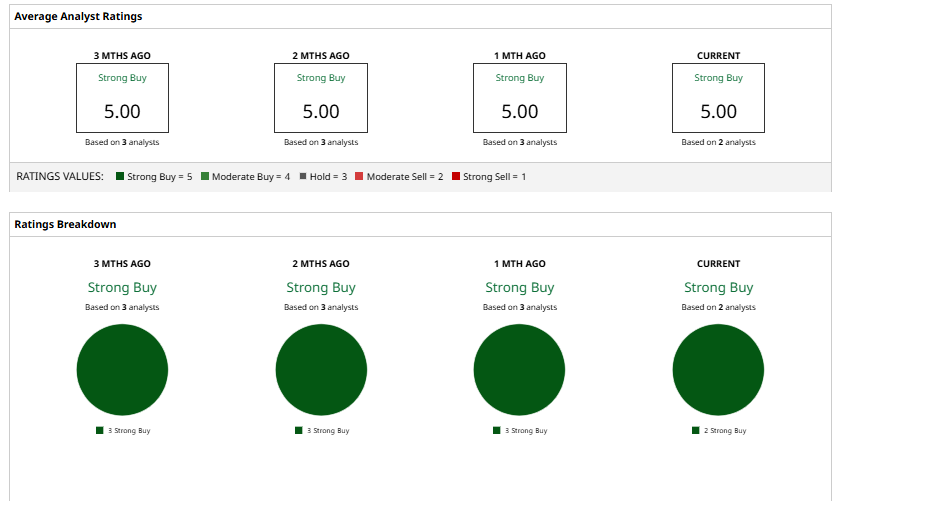

Analysts tracking GameSquare are highly optimistic about its growth prospects. The stock has a unanimous “Strong Buy” rating from the two analysts covering it, with a mean price target of $3, suggesting the stock could soar by 230%.

The Animecoin deal is clearly a positive move that aligns with GameSquare’s stated strategy and adds a guaranteed $2.5 million of creative-agency revenue. For risk tolerant investors, GameSquare might be an interesting speculative play. But if you are cautious about crypto’s volatility or prefer established fundamentals, this stock remains a high-risk name.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.