Oracle Is Cutting Jobs as AI Costs Surge. How Should You Play ORCL Stock Here?

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

Oracle (ORCL) is implementing strategic layoffs within its Oracle Cloud Infrastructure (OCI) division as the company reallocates resources to capitalize on the artificial intelligence (AI) boom, joining its fellow tech giants grappling with AI's escalating costs.

The job cuts, affecting hundreds of positions primarily in India and the United States, target the Enterprise Engineering division, Fusion ERP teams, and data center operations staff. However, this isn't a retreat from cloud computing as Oracle is simultaneously hiring new talent with AI-specific skills to support its growing focus on machine learning infrastructure.

The restructuring reflects Oracle's aggressive pursuit of AI market share against Amazon Web Services (AMZN), Microsoft Azure (MSFT), and Google Cloud (GOOGL). Its $30 billion annual agreement with OpenAI demonstrates a commitment to AI infrastructure, requiring massive capital reallocation to build specialized data centers and computing systems.

Is Oracle a Good Stock to Buy Right Now?

Oracle delivered exceptional fiscal fourth-quarter results that showcased the company's transformation into an AI-powered cloud infrastructure powerhouse, with management providing aggressive growth guidance that defied industry trends.

Cloud infrastructure revenue surged 52% to $3 billion, while total cloud revenue jumped 27% to $6.7 billion. More impressively, CEO Safra Catz guided for over 70% cloud infrastructure growth in fiscal 2026, up from 51% in fiscal 2025. Oracle’s remaining performance obligations (RPO) now stand at $138 billion, up 41% year-over-year, with over 100% RPO growth expected next year.

Oracle's unique position stems from its AI-centric database technology, Oracle 23 AI, which enables enterprises to use AI models on their proprietary data while maintaining security. "We have most of the world's valuable data," declared Chairman Larry Ellison, emphasizing that Oracle is "the key enabler for enterprises to use their own data and AI models."

Oracle faces unprecedented demand that "dramatically outstrips supply," forcing it to schedule customers into future delivery slots. Recent contracts include deals where customers requested "all the capacity you have wherever it is," highlighting the astronomical demand environment.

The company plans to increase capital expenditures to over $25 billion in fiscal 2026 from $21.2 billion, primarily for revenue-generating data center equipment. Management expects this may be understated given current demand levels.

Oracle's database-as-a-service offerings across Microsoft Azure, Google Cloud, and AWS are driving rapid cloud migration. The multi-cloud approach provides customer flexibility while maintaining Oracle's database dominance as enterprises modernize their infrastructure for AI workloads.

With total revenue guidance raised to over $67 billion (up 16%) for fiscal 2026 and confidence in exceeding fiscal 2029 targets, Oracle appears well-positioned to capitalize on the AI infrastructure buildout cycle.

What is the ORCL Stock Price Target?

Analysts tracking ORCL stock forecast revenue to rise from $57.4 billion in fiscal 2025 (which ended in May) to $122 billion in fiscal 2030. Comparatively, adjusted earnings are forecast to expand from $6.03 per share to $14.51 per share in this period.

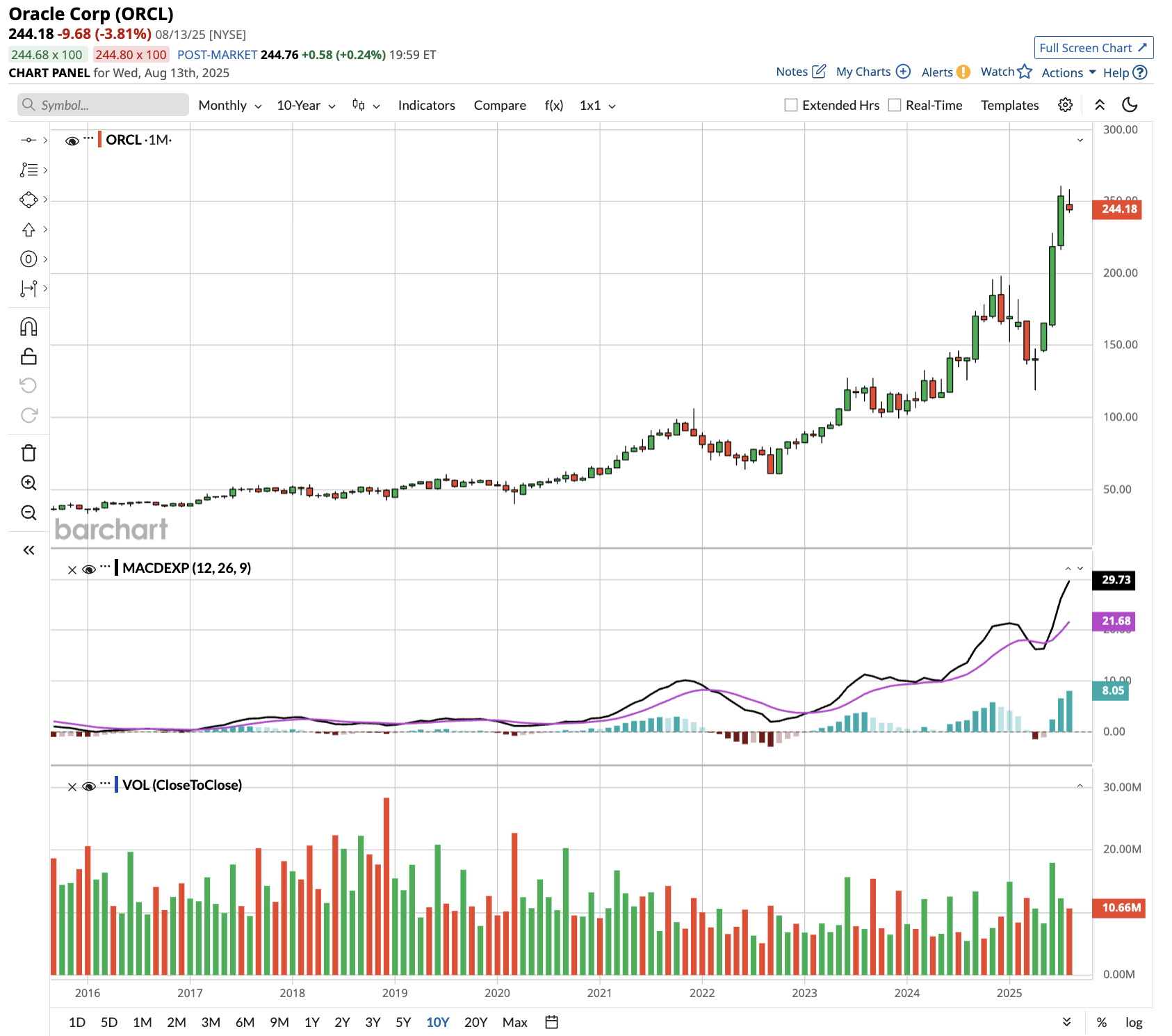

ORCL stock has returned over 350% to shareholders in the last five years. Today, it is priced at 36x forward earnings, above the 10-year average of 17x. Even if priced at 30x earnings, then it should trade around $435 in three years, indicating an upside potential of almost 80%.

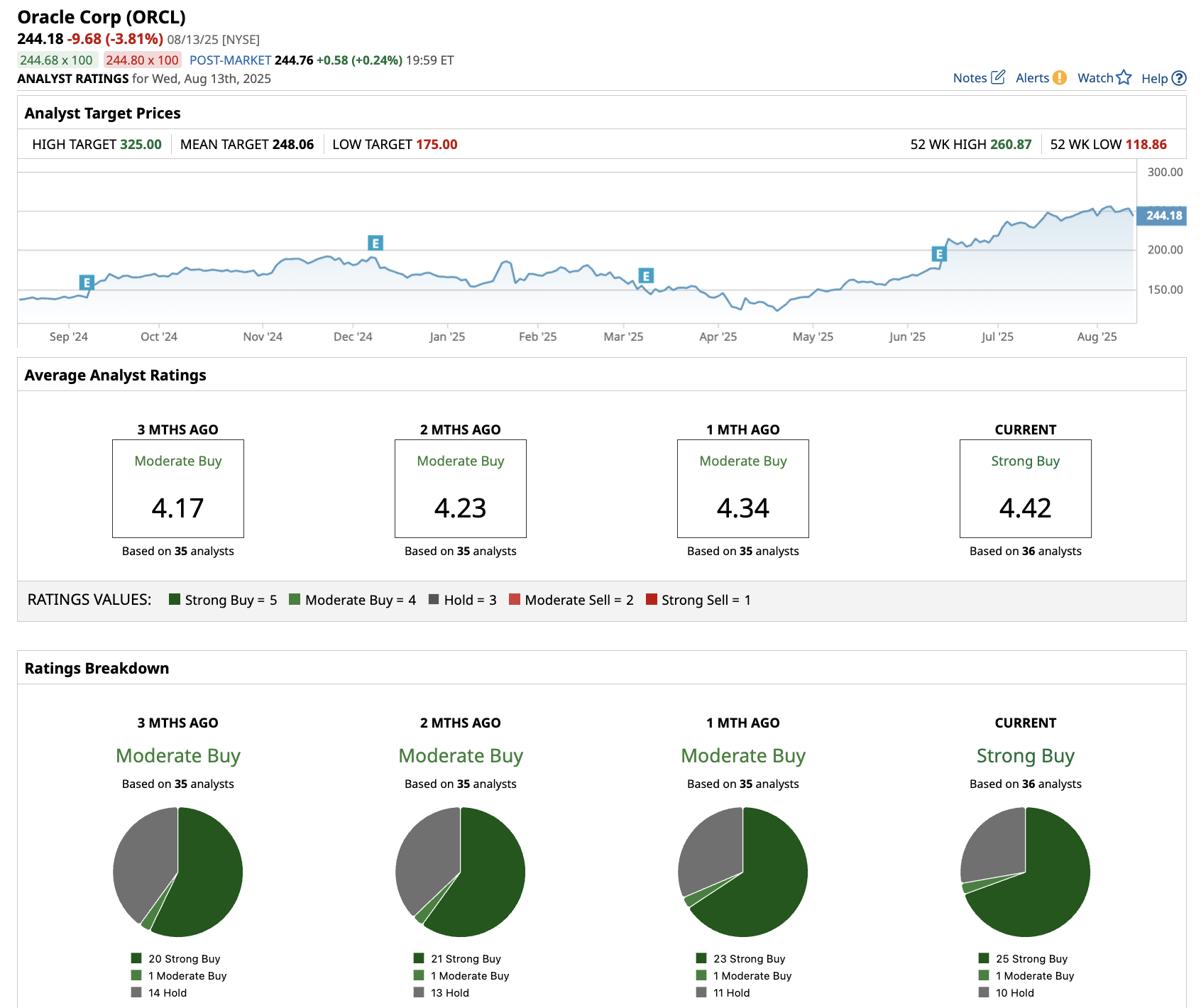

Out of the 36 analysts covering ORCL stock, 25 recommend “Strong Buy,” one recommends “Moderate Buy,” and 10 recommend “Hold.” The average target price for ORCL stock is $248, marginally above the current price of $244.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.