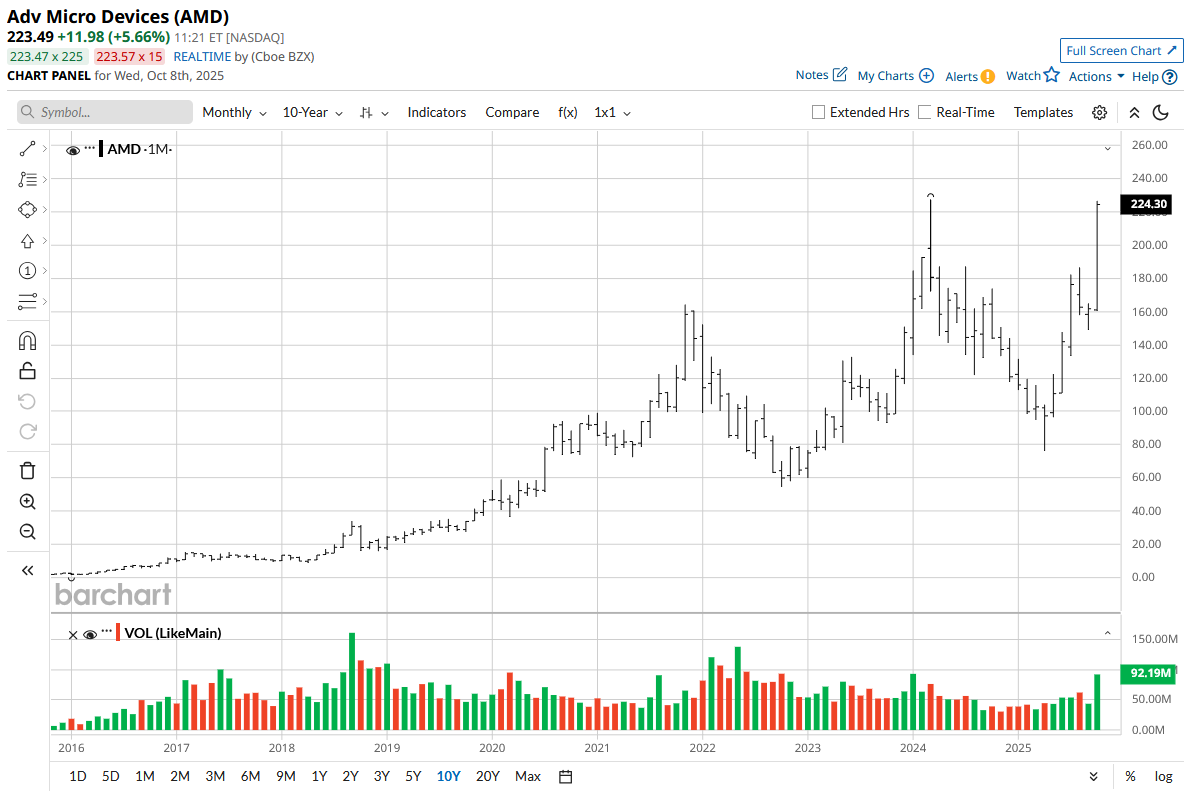

AMD Stock Is Soaring on an OpenAI Deal, But Analysts Still Think It Can Climb 35% From Here

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

AMD (AMD) stock surged nearly 24% on Monday after the company announced a partnership with OpenAI, which could give the ChatGPT maker a 10% stake in the semiconductor giant. OpenAI will deploy six gigawatts of AMD's Instinct graphics processing units (GPUs) over several years, starting with a 1-gigawatt rollout in late 2026.

The agreement positions AMD as a core strategic partner to OpenAI, marking one of the largest GPU deployment deals in the AI industry. As part of the deal, AMD issued OpenAI a warrant for up to 160 million shares, with vesting tied to deployment volume and AMD's stock price performance.

OpenAI President Greg Brockman emphasized the partnership's importance, noting the company currently lacks the computing power to launch many revenue-generating ChatGPT features.

CEO Lisa Su highlighted that AI remains on a 10-year growth trajectory, which requires foundational partnerships to bring the best technologies to market. This deal comes just two weeks after OpenAI's $100 billion agreement with Nvidia (NVDA), bringing OpenAI's total infrastructure spending to roughly $1 trillion.

While Nvidia's stock dipped 1% on the news, the AMD partnership helps diversify OpenAI's supply chain and reduces dependence on a single vendor. For AMD stock, the deal validates its next-generation Instinct roadmap after years of trailing Nvidia in AI accelerators. CFO Jean Hu expects the partnership to generate tens of billions in revenue while being highly accretive to earnings per share.

AMD Is Expanding Its AI Ecosystem

AMD is making significant strides in artificial intelligence, and executives are confident that the company can become a major player in the GPU market. The chipmaker recently reported $7.7 billion in second-quarter revenue, a 32% year-over-year (YoY) increase, with strong momentum continuing into the third quarter.

The data center business hit $3.2 billion in the second quarter despite being unable to sell its MI308 chips to China. That setback forced AMD to write off $800 million in inventory. Even with that headwind, the company saw record server CPU sales and expects double-digit sequential growth in the third quarter, driven by its new MI350 chip.

AMD is taking a deliberate, multi-generational approach to the AI accelerator market. The strategy mirrors what worked on the CPU side, where AMD gradually built competitiveness over several generations. The MI300 and MI325 focused on inference workloads, where AMD's chiplet architecture provides more memory than competitors. The MI355 adds training capabilities, and next year's MI450 represents what executives call their "no asterisk" generation, targeting leadership performance across all AI workloads.

AMD has over 40 active sovereign AI engagements globally, which executives see as incremental growth beyond hyperscale customers. The chipmaker is working closely with the U.S. government on licensing to address this multibillion-dollar opportunity. AMD already counts seven of the top ten AI spenders as customers and expects that number to grow.

On margins, AMD's data center GPU business runs slightly below the corporate average as the company prioritizes market share in this hyper-growth market. Executives are confident margins will expand over time as the business scales. It is focused on maximizing gross margin dollars rather than percentages.

AMD believes programmable GPU infrastructure will capture 75% to 80% of the AI market, with custom ASICs serving the remainder. The company sees AI driving unexpected demand even for traditional CPUs as companies deploy more sophisticated applications.

Is AMD Stock Undervalued?

Analysts tracking AMD stock forecast revenue to increase from $25.8 billion in 2024 to $68.5 billion in 2028. Comparatively, adjusted earnings are forecast to expand from $3.31 per share to $11.62 per share in this period. If AMD stock is priced at 30 times forward earnings, which is a reasonable valuation, it could surge 66% over the next 30 months.

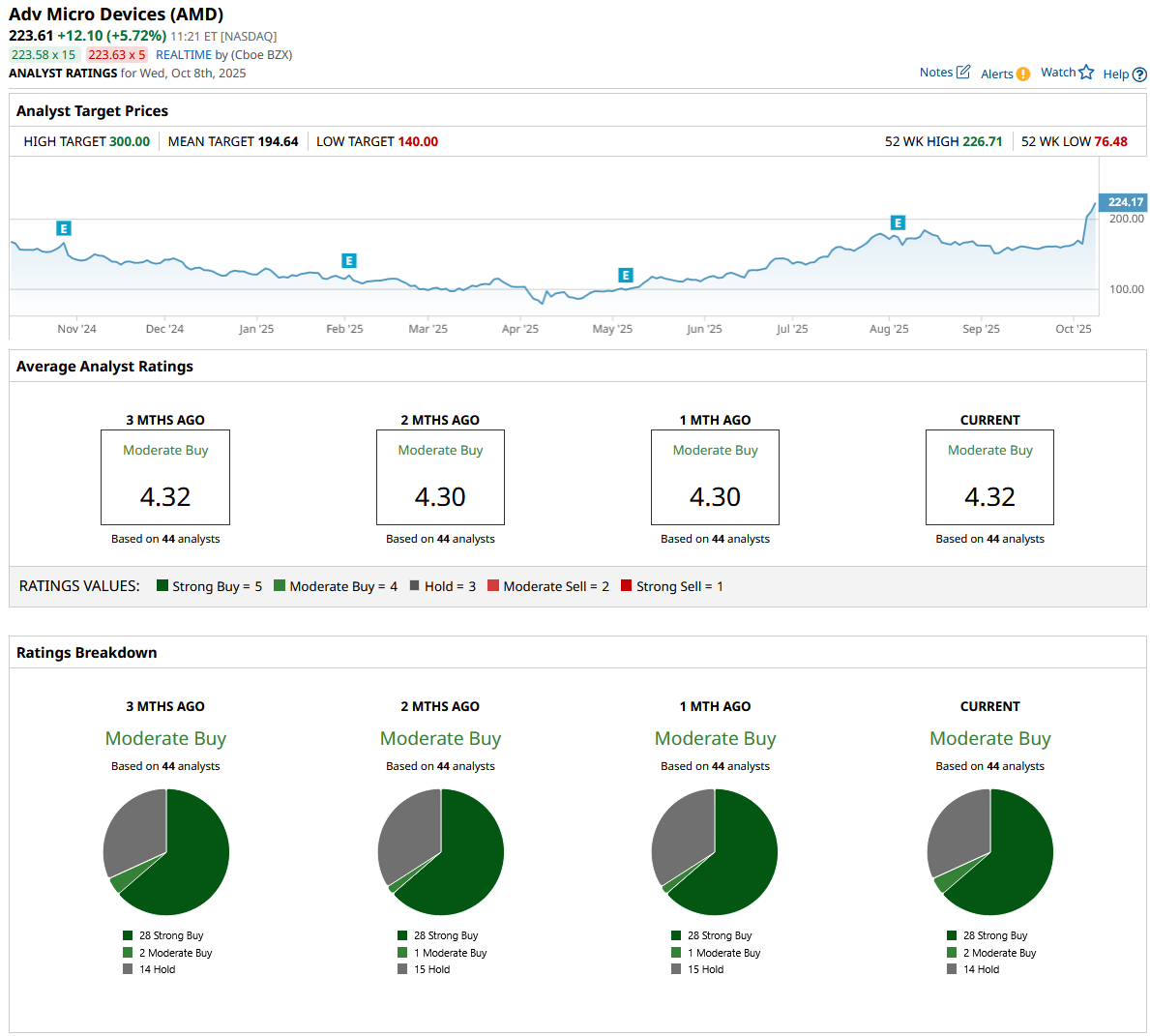

Out of 44 analysts covering AMD stock, 28 recommend “Strong Buy,” two recommend “Moderate Buy,” and 14 recommend “Hold.” The average AMD stock price target is $194.64, below the current target price of $223. However, the high target of $300 set by Barclay's gives the stock a good 35% left to run.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.